Relying on the Best Online CFD Brokers

By Content-mgr - on June 16, 2016Online CFD brokers are able to facilitate superior trading conditions. And to offer unique liquidity even at time when classic brokers simply can’t. The impact this has on wise forex and commodity traders is underestimated, and critically important. This is because these FX and commodity CFD traders are wise enough to deal with market risk, through hedging trades. This allows them to limit losses when wrong, and to be wrong more often. But the hedging trades are handled differently when the trade in question goes well. So that the hedging trade doesn’t offset the profit of a good trade. It’s hard to visualize, but the instruments themselves are linear, very linear in fact. There is nothing hidden in the pricing of a CFD contract that would even suggest asymmetrical trading possibilities. But hedgers do need linear CFD pricing, as opposed to say Futures, which are not linear. The asymmetry arises from the way that these wise traders judge the market. Through the use of mental stop levels, pivotal levels, and more. The hedging trade has a different trigger level than the level at which the initially intended trade was opened. These factors do create asymmetry, because market price inherently has properties of asymmetrical behavior. Entire CFD trading systems are based on these overlooked concepts. And there is no need for fancy CFD trading software products, traders do the research on their own. Classic statistics does not recognize these asymmetries. So at any given time, the theorists assume that the probability of market price going up or down, is equal and symmetrical, that is 50-50. But we know for a fact, that at times of momentum, such as breakouts, this isn’t so, and the probability of going in one direction only is far greater than that of going in the other. The entire Options industry is based on this simple statistical model, where the assumption is a 50-50 chance on market direction. Option traders think and act just like those wise CFD traders, waiting to see when one direction will become much more likely than the other direction. The difference is that with Options is very difficult to make money, as there are too many factors involved. And the minor oversight can ruin the entire trade. With CFDs you can plan the trade, and you only need to worry about few factors, such as momentum, pivotal levels, volatility, and what trade size to use. The objective is to always look to gain an edge over classic statistics, and profit from some asymmetry in the market. Online CFD brokers facilitate this kind of trading very well.

Online CFD Brokers are Also Ideal for Specialized Stock Trading

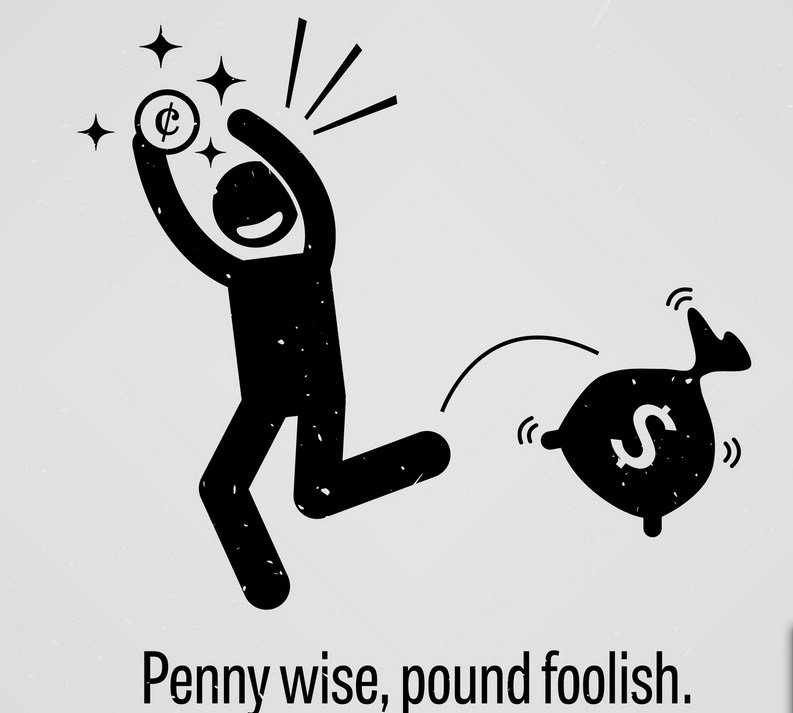

Stock traders, obsessed with medium term fundamentally driven trends use online CFD brokers for their trades. Especially in the case of small volume stocks, penny stocks, and stocks where liquidity may be an issue at times. CFDs remove huge liquidity problems. Traders are assured that they will never get trapped in a trade they can’t get out of, or be unable to enter a short trade. Classic stock traders don’t have this assurance. And in the case of penny stocks in particular, it’s absolutely nonsense to trade directly. As a minor problem in closing the trade could mean many 100s of dollars evaporating off your profitable trade during the delay. With CFDs it’s in an out, no questions asked. CFDs have size limitations are still more than enough for most retail traders. CFDs are the best way retail traders can trade, and even if there are huge commissions charged per trade by your CFD broker, don’t be discouraged. Because your CFD broker is able to fill you at any time, thereby saving you those 100s of dollars on your best trades. So in fact, even a high cost CFD broker is much much better than classic brokers, who lure clients on the promise of low cost trading only to cost them a fortune in the long run. Trading CFD for a living is about fact and looking for what’s under the hood. Only penny wise – pound foolish traders ignore liquidity.

First Deposit Bonus

First Deposit BonusFirst Deposit Bonus | Phone Verification | First Trade on us | Account Verification