Foreign Exchange Currency Symbols and Indices

By Content-mgr - on April 10, 2016Foreign exchange currency symbols and indices are used by rating agencies, banks and financial data providers to measure and chart key currency related markets.

Foreign Exchange Currency Symbols and Indices beyond the Popular Pairs

Foreign exchange currency symbols and indices are used in the financial industry. They are essentially markets, ETFs, and indices of all kinds, which track the performance of the underlying currency. Foreign currency trading involves doing a lot on research. Not just on the actual traded pair, but also on all these other indices and related markets. Some of them are also available for trading through CFDs and various instruments. Other symbols are simply market performance measuring indices, defined and provided by financial agencies and banks. They are all useful at one time or another. Because they provide insights into the underlying market, which the main currency pairs may not provide as clearly. Entire forex trading strategies are based on inter market analysis. And part of this analysis involves the study of these derivative foreign exchange currency symbols and indices. Traders are able to infer valuable information from chart patterns which may appear here and there. But not necessarily on the same index all the time. The objective is to trade the underlying currency, but then arises the question, which market exactly? For example the US dollar index (symbol $USD) is an index tracking the performance of the US dollar. Whereas the PowerShares UUP symbol stands for an ETF tracking the bullish performance of the US dollar. Basically, they are all tracking the US dollar currency. And they are all helpful one time or another, for doing analysis on EURUSD, and deciding how to trade this very liquid currency pair. Oftentimes you will find chart patterns on $USD or UUP which may be very useful, and conclusive on direction. While at the same time you may or may not find such patterns on the EURUSD chart. So looking around these symbols and their charts, can help clarify the whole picture and minimize ambiguity. Because EURUSD charts are never very simple. As one zooms in and out on the chart conflicting signals appear. The daily chart on the US dollar index ($USD) does carry a lot of weight, as you are looking on the US dollar against 6 currencies. EURUSD is very large by volume, but still only shows the US dollar against one single currency. Moreover, being a large currency, does not necessarily make that currency a leading one.

Foreign Exchange Currency Symbols and Indices Matter to Swing Traders

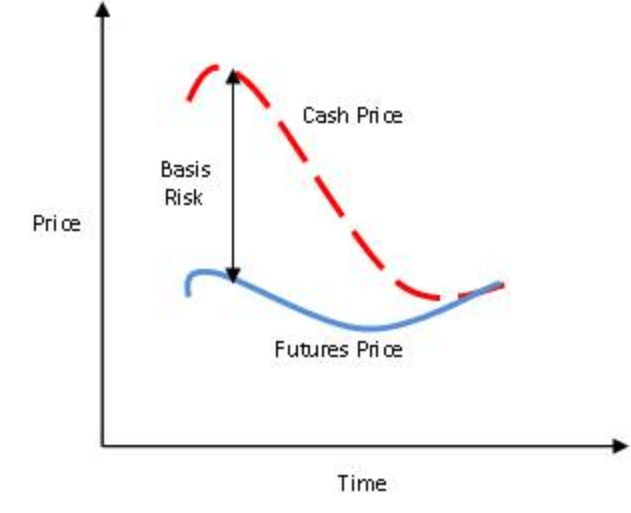

Foreign exchange currency symbols and indices matter most to swing traders. Since these do a lot of observations on the daily charts. Patterns such as gaps, divergences, flags and more may be hard to observe on one index chart, and yet be visible on another. Moreover some of these indices and ETFs may provide leading signals over currency pairs. The assumption is that some of these markets are traded in the derivatives and Futures markets also. And some institutional investors make large trades in the Futures markets, before they make more trades in the underlying currency pairs. They also do this with stocks. This strategy of doing half the transaction through the Futures, and the other half shortly after through the underlying market allows them to get an overall better-lower entry price. Because buying all at once does actually make the market move higher in the process. And the reverse is also true for selling. To the small and medium size retail trader this is useful for trading online. Since they can spy on institutional Futures trading activity, and place their own trades early enough, through highly linear CFD contracts. If their observations are correct, the underlying markets will move as expected. And the CFDs will capture the maximum amount of price movement possible, and in the most affordable way! So spying on currency related ETF Futures activity, and trading on the information through CFDs can offer you a head start on the coming trend. Trading the Futures directly is possible but doesn’t make sense, because they are the indicator. And they work as an indicator only because they don’t have linear pricing relative to the market like CFDs have. Which makes CFDs the instrument of best choice for doing the actual trade.

Assessing market activity based on futures and perceived risk is especially useful in commodity currencies. Many currency trading strategies can be improved through such risk analysis. USDCAD for example will definitely move lower should crude oil start rising steadily. And the only immediate risk in crude oil is when it starts going higher, not lower. So USDCAD traders should pay attention to crude oil futures at time of suspicion, where a rally in energy prices is likely to happen. There is an asymmetry here, because risk only indicates one side of the market. If risk premiums were normal or too low, they would be meaningless. But increased risk premiums for crude oil can only mean rising prices, and therefore a falling USDCAD price. Risk premium analysis, when yielding a signal, overrides all other conflicting technical indicators. Commodity currencies have this advantage that traders can exploit. Because commodity supply is finite, and fears of future supply problems lead to surprise rallies.

First Deposit Bonus

First Deposit BonusFirst Deposit Bonus | Phone Verification | First Trade on us | Account Verification