All about Online CFD Trading App Tools for Mobile Users

By Content-mgr - on June 21, 2016A CFD trading app, can help the user-trader enhance any slow trading strategy. Through identification of pivotal levels on the market charts, and other valuable information. A good CFD trading app serves the purpose of lessening the workload of the already experienced trader. All of these tools however are designed for trading on the move. Hence they are not suitable for very fast trading. Especially under volatile conditions. Online CFD trading is a serious task, and this requires a certain amount of concentration. This is why intensive, time-sensitive trading cannot easily be achieved in public places. As even the minor distraction can make the trader lose focus, and make a poor decision. Traders however who trade slowly, and want to get updates on their open trades and the market, are much safer. Their lower volatility CFD trading system, allows them to do that while away from their desk. In any case however, wise traders learn to be patient and think hard before making a trade. Even wise day traders. New traders just need to be careful not to be fooled into believing that these apps will do all the work for them. Because they won’t. These trading apps simply assist in the completion of the task. The thinking and decision making is always left to the trader.

Where a CFD Trading App Excels

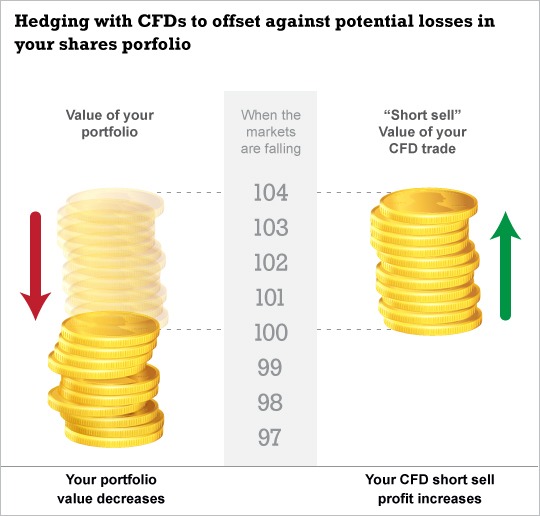

In some cases, where a complex, sophisticated CFD trading system is used. Which includes both position trading and day trading, the CFD trading app user has an advantage. Because such an app can be used to perform the time consuming and precision-critical task of trade size. So that the trader knows exactly what the size of a small hedging trade should be. The longer term position trade reflects the daily trend of the market in question. Whereas the smaller day-trade reflects the hedging trade, which is smaller, but needs to be placed properly. Inevitably, the software makes the assumption that the daily trend of the market will not really change. This is quite a safe assumption to make, but not absolutely safe. Another assumption would be that the market will move against the daily trend, for about 3 days. A smart trading app, based on these relatively safe assumptions can help. Because it will calculate the exact hedging trade, either one trade lasting 3 days, or 3 individual trades. Traders and investors use such apps all the time to calculate short term risk in their portfolios. Using the right size hedging trade is critically important. And traders have to do this while on the move, right from their smartphones, and without having to use a pen and paper to calculate the numbers. An app calibrated on the trader’s parameters can do the job in no time, and very accurately.

Time Management

Trading CFD for a living may or may not require the trader’s extensive attention. Basically, the smaller a CFD trading account is, the more actively the trader needs to trade, to generate profits. And these trades require even more time to detect and evaluate. So even for these traders with small accounts, a good app can be used to detect and evaluate market signals while on the move. And the trading itself can be done at home if the trader prefers to work at their desk. By making wise use of all available time to analyze and assess the market from a smartphone app. The trader will be able to filter out many false, or ambiguous signals. Ideally, one would want to assess major trading signals twice. Once as soon as they are detected. And once more later on, with a clearer, less biased mindset. Sometimes, as the market changes during the short time elapsed between different checks, something happens. Not only is the trader more unbiased in their judgment, but also market price itself may validate a new signal.

First Deposit Bonus

First Deposit BonusFirst Deposit Bonus | Phone Verification | First Trade on us | Account Verification