Forex Trading Calculator Tools You Don’t Need

By Content-mgr - on March 20, 2016Most forex trading calculator tools are useful, but there are some which have been made available by popular demand. Deep down though, they are simply useless.

Forex Trading Calculator Tools You Can Do without

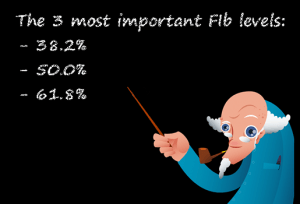

Most forex trading calculator tools, such as trade size and stop loss calculators are very useful, and so are LSS pivot point calculators. There are however some forex trading calculator tools, such as Elliot wave theory and Fibonacci tools, which are embedded in trading platforms and charting software, simply due to popular demand. Using an Elliot wave theory forex calculator and price projector, is totally useless and misleading. The theory is totally false and unproven. The same goes for Fibonacci theory as well. These theories were once believed to work, based on the idea that too many traders would act the same way, upon seeing the same signals. Real tests however have shown that not all theories really work. Many of them simply don’t work because not many traders act on them. LSS pivot theory is debatable, it does work very often and it often works at critical price levels. But even LSS pivot theory cannot be totally dependable, since there is always some element of ambiguity. Any theory based on support and resistance seems to be working perfectly, because no matter what market price does, the theory seems to match the trading action. LSS pivot theory however does provide warning signals, and that alone can be used to adjust stop loss size accordingly. Which is very useful. Forex charts are very confusing and ambiguous at all times, it is natural. However, Fibonacci and Elliot wave theory are among the two biggest losers, because they are more myth that fact. Some new traders spend many hours of their research time, analyzing markets using these false theories. Time that would much more productive had they been using other theories, such as swing trading theory or time zone analysis.

Why Proponents of those False Forex Trading Calculator Tools still Believe in them

These forex trading calculator tools rely on Fibonacci and Elliottt wave theory. Theories which if one has enough wishful thinking and confirmation bias, will surely find some market charts perfectly matching their concepts. But that is not real, unbiased research. Moreover these false theories have been mythologized by all kinds of traders, even by profitable traders. So, new traders do not dare question the opinions of profitable traders. Believe it or not, no matter how profitable a trader, user of these theories and calculators, might be, they are only fooling themselves. The most logical explanation is that they use these false theories alongside some solid theories, which ultimately kept their trading profitable. Forex exchange rates and their trend are hard to figure out. The list of false theories in trading, goes on and on, and it includes some other supposedly good trading theories also. These supposedly good ones, are theories such as contrarian indicators and the COT report. These theories use real data, they are right some of the time, but their accuracy in predicting market turning points, is very poor. Perhaps as good as a tossing a coin. There is some predictive power in contrarian indicators, and even though the theory is not used in calculator tools, it is used in graph form. These graphs do accurately confirm existing trends, much better than classic market price moving averages. They are not however leading indicators. Because many times, the crowd can actually be right, and the minority will be wrong. But as the new trend develops in the market, after the reversal, the majority of new traders are not willing to take a loss on their losing trades. And so the contrarian indicators do very accurately show that the market will continue to move in the direction of the few for a while.

First Deposit Bonus

First Deposit BonusFirst Deposit Bonus | Phone Verification | First Trade on us | Account Verification