The Advantages of Using an Online CFD Simulator

By Content-mgr - on November 2, 2016Most losing trades make sense when seen in hindsight. But in fact, you can learn to detect them early, through probability analysis and an online CFD simulator.

An Online CFD Simulator for Evaluating Risk Control Methods

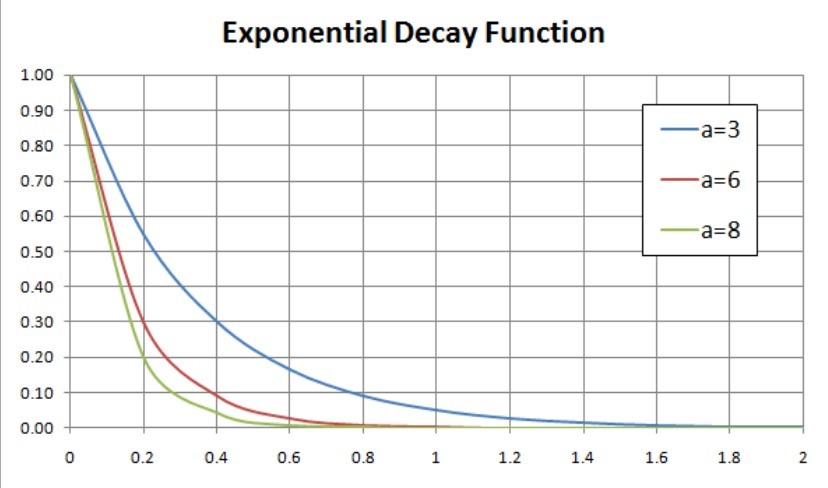

An online CFD simulator allows you to test theories and ideas on risk control. And to explore the hedging power of CFDs. So as to get around the riskiest periods in the markets. The biggest losing trades occur exactly because traders fail to focus enough. They fail to evaluate the uniqueness of each trading day, and the volatility risk. What usually happens is that traders are caught on the wrong side, trying guess market direction. And all this fear and confusion leads to closing the right trade. The right trade could be the one that is actually a losing trade at the time of taking action. That’s why probability analysis through both time and price data, is so important. Because unlike what your instinct tells you to do, the analysis will tell you otherwise. And the analysis will have a much higher probability of being right. To be exact, traders who employ such risk control methods don’t come up with a buy or sell formula. But rather with an algorithm, which has many steps and conditional decisions to go through. In some cases it will tell the trader to close the open trade, regardless of profit/loss. Because the probability of success is diminishing exponentially with the passage of time. In other cases, it will tell the trader to temporarily hedge an open losing trade with an offsetting CFD trade. Because the probability on a longer time frame suggests it’s the right thing to do. And through multi-time-frame probability analysis, it will finally tell the trader how to handle the open trade and the hedging trade. This approach saves the trader a lot of stress, and offers a map to navigate through the confusing markets. This is all tested and improved in an online CFD simulator.

The Market is Not always Right!

The urban legend says that the market is always right, but we don’t care about the latest price momentum. Because that’s what the legend refers to. We care about prevailing probability, and that’s what really matters. And moreover the trend is a function of time. A trader’s trend might be up, while another trader’s perception of trend is down. If you attempt to analyze the markets through probability theory and logic. You need to start simple, by applying your theory to 3 time frames simultaneously. So that you have one shorter and one longer time frame, while looking to start trading on the middle one. CFD trading news based strategies are not advised. As news trading is also a subject of intense debate, due to many myths taught. A CFD trading system works best when the benefits of CFDs are exploited, and when the trading myths are left out.

Testing Simple Concepts through an Online CFD Simulator

An online CFD simulator can be used to test hedging concepts based on multi-time-frame analysis. And concepts of stops in the time domain. Typically, some popular markets tend to have critical pivotal times. Which range from 20-30 minutes to around 3 days, for 5 minute and daily charts respectively. So day traders will consider closing open trades after 20-30 minutes, counting from exact entry conditions. When the entry to the market was made using the right criteria, and the time limit is elapsed, it makes no sense to wait longer. Probability favors closing that open trade and start planning the next one. Far too often you will see that you will be able to close marginally profitable trades before they turn into losing ones. That’s the basis for probability analysis, in a nutshell… But you can take things much further through more data and more advanced probability calculating tools.

First Deposit Bonus

First Deposit BonusFirst Deposit Bonus | Phone Verification | First Trade on us | Account Verification