The Importance of Reading and Understanding CFD Trading News

By Content-mgr - on December 15, 2016CFD Trading News Does Matter when Markets are Volatile. News is not the cause of market movements, but rather the triggering cause. These conditions matter!

CFD Trading News Can Trigger Major Day to Day Movements

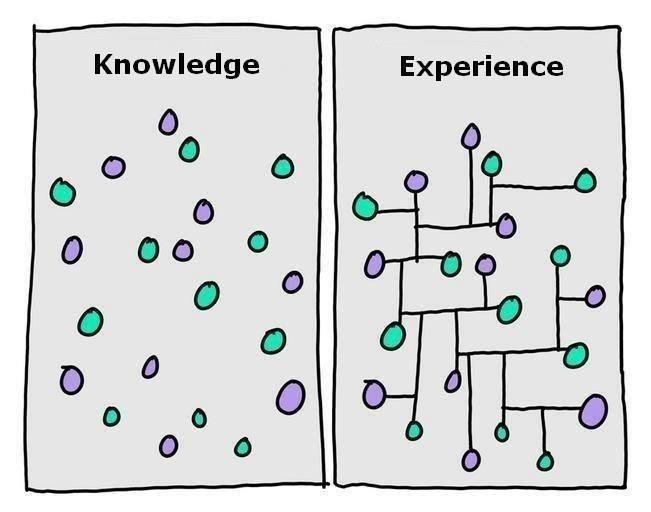

CFD trading news, though little understood by all the traders and analysts, is useful from time to time. The news itself is an indicator of volatility. And in already volatile market conditions, it can be used to refine market timing. Simply by regarding the news as the triggering cause of these market price moves. No CFD trading system is ever complete without risk and volatility analysis. And news can be used to confirm apparent volatility. In order to better anticipate what’s coming next. CFD traders who know their markets well, especially commodity CFD traders, do use news. The secret is in not getting carried away and biased because of the new. Because the market can discount, or price in news, much faster than any trader can. So the old adage of buy the rumor, sell on the news… it’s definitely true. Wise CFD traders attempt to see how the market collectively will react to news. And if a news trigger is enough to unleash momentum in price. And as the market moves beyond critical stop loss levels, more and more traders will change direction. And the market may continue to move in the direction of the original momentum. For as long as several days at a time.

CFD Trading News in Commodities

CFD traders know their commodities and other related markets. CFD trading news is bound to shake their exposure to the markets, and that’s why technical calculation of risk is never enough. The market simply defies technical support and resistance in a confusing way. And tight stops fail miserably to maintain a good overall risk-reward figure. Wise traders know their markets and simply get around this problem by looking into longer term direction. And by utilizing large stop loss orders, so large as to embrace the higher volatility. Foreign exchange currency trading online for beginners tends to teach the exact opposite. And this is why new traders misunderstand risk management right from the beginning. The very act of using tight stops, is a recipe for total failure, especially during high volatility. Tight stops simply don’t work, period. And anybody who is afraid of embracing market risk, is not a candidate for becoming a profitable trader. Volatility and surprise moves are what make markets interesting, so risky, and eventually so profitable.

Market Risk Redefined

Market risk as seen through volatility and the news is still hard to measure and put to good use. Wise CFD traders go a step further by first identifying fundamental direction. Which may or may not be triggered by the news in the coming several days. And then, they are willing to trade either direction, or even both. They are essentially ready to make trades against their own fundamental analysis. Because if the trend is not triggered by the news, all kinds of counter moves are to be expected. And far more often than not, this is actually the case. Fundamental analysis gets right the direction, but its timing is horrible.

First Deposit Bonus

First Deposit BonusFirst Deposit Bonus | Phone Verification | First Trade on us | Account Verification