Oil prices fell by about 2%, and global benchmark Brent held below $80 a barrel, on the prospect successful Middle Eastern peace talks could reduce supply risks, while leading oil importer China’s economic weakness looked set to curb demand.

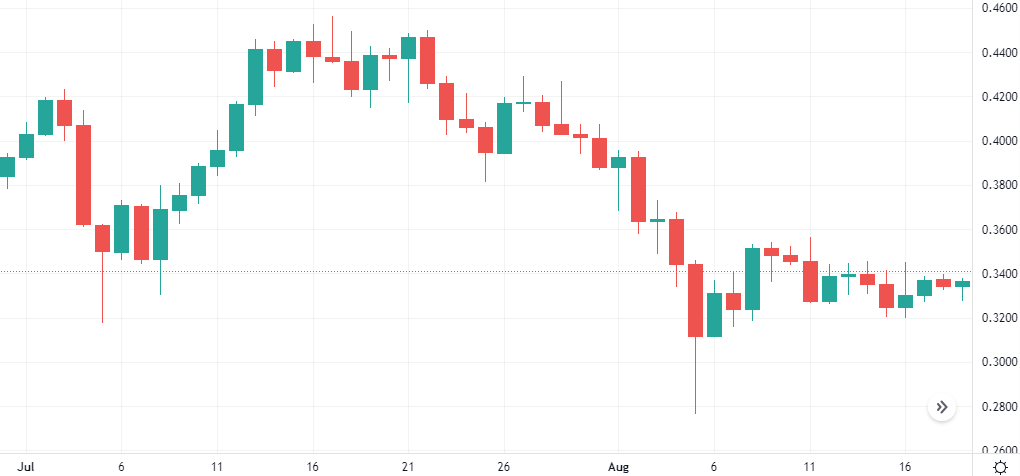

The Oil-Dollar pair corrected downwards in the last session, falling 0.2%. The ROC is giving a negative signal.

WTI/USD made a minor downwards correction of 0.2%.

The ROC is currently in the negative zone.

Support: 76.61 | Resistance: 79.981