Dual risks kept investors on edge ahead of markets reopening, from heightened prospects of a broad Middle East war to U.S.-wide protests against U.S. President Donald Trump that threatened more domestic chaos.

Dual risks kept investors on edge ahead of markets reopening, from heightened prospects of a broad Middle East war to U.S.-wide protests against U.S. President Donald Trump that threatened more domestic chaos.

The dollar has sunk to its lowest in three years as rapidly changing U.S. trade policy unsettles markets and expectations build for Federal Reserve rate cuts, fuelling outflows from the world’s biggest economy.

Gold prices scaled a one-week peak, steered by simmering Middle East tensions and cooler U.S. economic data that fuelled fresh bets on Federal Reserve rate cuts. U.S. gold futures settled 1.8% higher .

The Gold-Dollar pair gained 1.0% in the last session after a 1.1% intra-session dip. The CCI indicates an overbought market.

Support: 3345.6 | Resistance: 3510.2

U.S. President Donald Trump said he would not fire Federal Reserve Chair Jerome Powell, adding that he “may have to force something” as part of his ongoing push for the central bank to lower rates.

Britain’s borrowing costs rose and sterling stayed close to recent three-year peaks against the dollar, as a multi-year spending review underlined fiscal challenges even as pressure mounts to boost the economy.

The Pound got a slight bump of 0.2% against the Dollar in the last session. The Stochastic-RSI is giving a negative signal.

Support: 1.3379 | Resistance: 1.3685

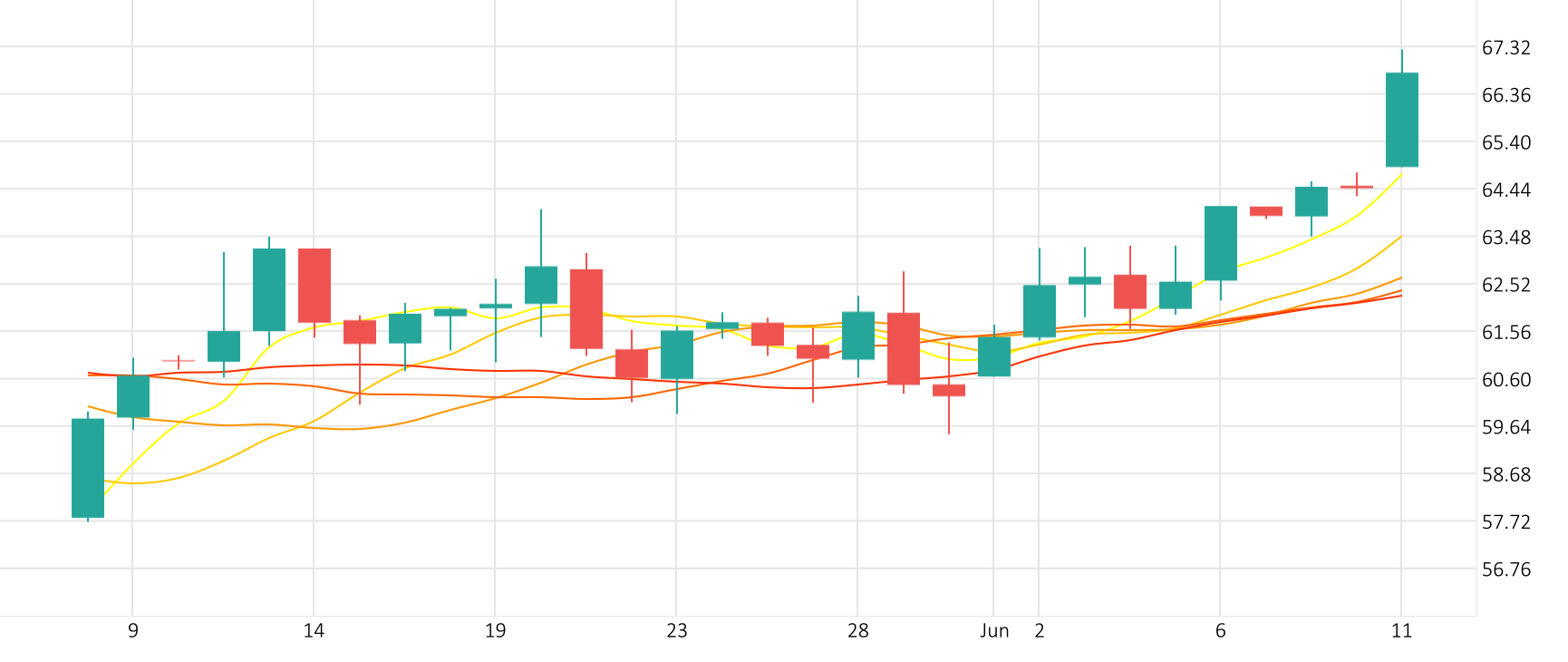

Oil prices rose more than 4%, to their highest in more than two months, after sources said the U.S. was preparing to evacuate its Iraqi embassy due to heightened security concerns in the Middle East.