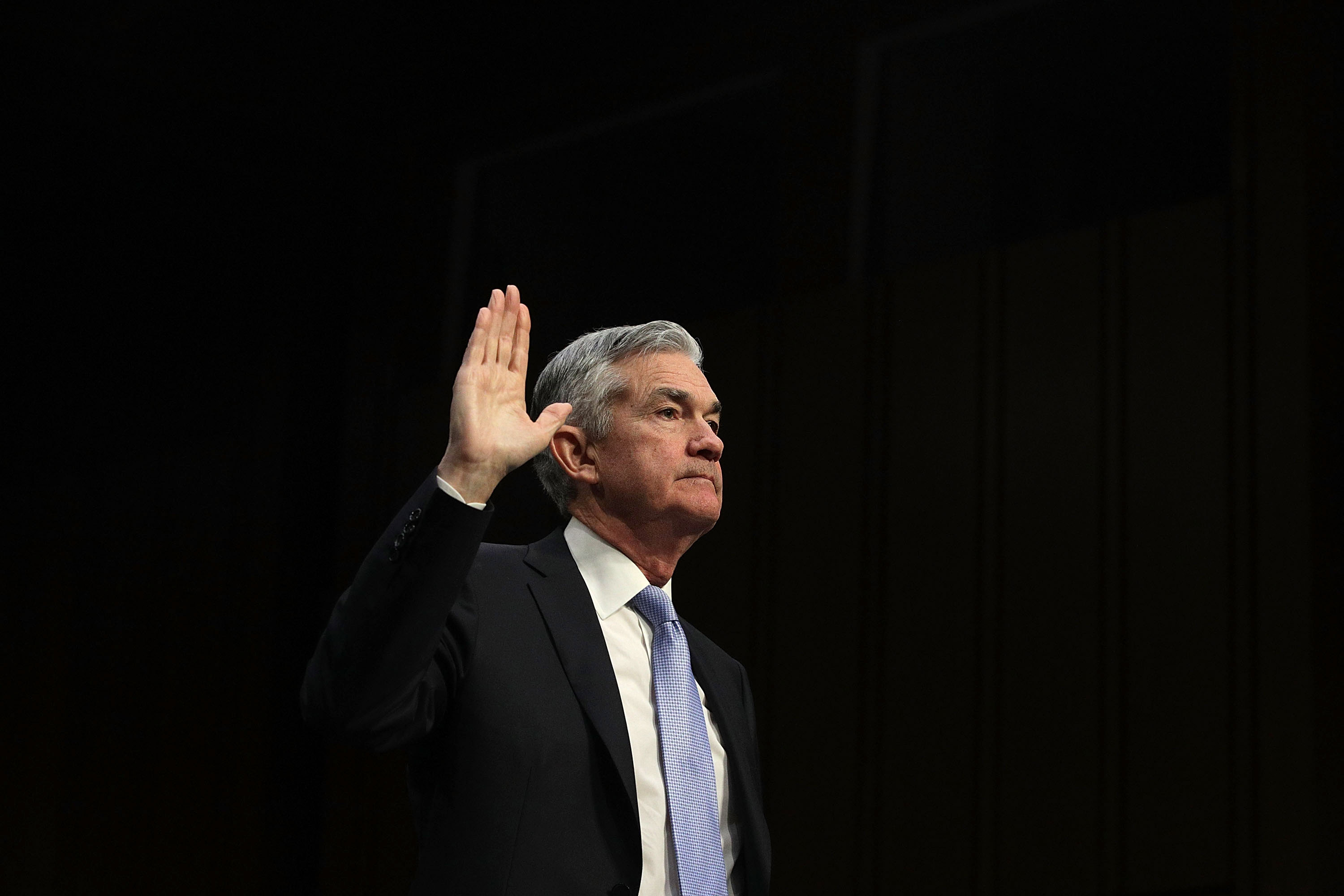

USD remains the strongest currency across the board. Dollar remains broadly supported after Fed Chair Jerome Powell reiterated on Tuesday that the U.S. central bank would likely move forward with gradual increases in interest rates. Today’s good US economic releases also supports strong USD.

USD/JPY jumps to fresh session tops, eyeing a move beyond 107.00 handle. Currently The US dollar is heading for its second-best monthly performance of the Trump presidency as investors pencil in the possibility of additional interest rate rises this year. The dollar index was up 0.3% to 90.604 on Wednesday which leaves it 1.7% higher for February, on track for its best month since November 2016 when Mr Trump was elected president.

The U.S. 10-year Treasury yield stood at 2.841%, continuing to move away from a four-year high of 2.957% reached last week.

The euro slumped to its worst level since Jan. 18 at $1.2180, hurt by political uncertainties as Italians are preparing to vote in a national election on Sunday.

The British pound fell to $1.3727, its lowest since mid-January, pressured by renewed worries over Brexit after British Prime Minister Theresa May said the EU’s draft legal text published on Wednesday would undermine Britain and threaten its constitutional integrity.

Sources:

https://www.fxstreet.com/currencies/us-dollar-index#latestnews

https://www.ft.com/markets/currencies

https://www.ft.com/content/7a24997e-1cb6-11e8-956a-43db76e69936

https://www.investing.com/rates-bonds/u.s.-10-year-bond-yield

https://www.investing.com/quotes/us-dollar-index

https://www.investing.com/news/forex-news/forex–dollar-at-6week-highs-on-us-rate-hike-hopes-1318871

https://www.investing.com/news/economy-news/top-5-things-to-know-in-the-market-on-thursday-1318883