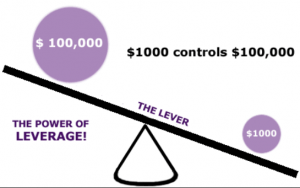

Most traders know more or less what is forex leverage. Because it impacts their buying power and risk, in their accounts. Leverage is simply trading on margin.

What is Forex Leverage Used for

If you wonder what is forex leverage used for, it is simply used as a way to trade on margin. Or in other words, to trade on borrowed funds. These funds are provided at an interest rate. And in currencies you get paid interest when you are long. And you pay interest when you are short. Directional traders and Carry traders know what is forex leverage used for, and how it impacts their accounts. The vast majority of traders are directional traders. And these simply want to know how the effect of leverage will impact their trading. Leverage increases their buying power, so that both risk and reward are increased many times. Many traders use 100 to 1 and even 200 to 1 leverage. Which means their funds go a long way, but so does risk too. Leverage also determines the amount of money risked per currency pip. So pip value will vary from account to account based on the leverage used. Forex trading strategies range from simple to very complicated ones. Most of these are directional, and leverage can have a huge impact. Both bad and good. That’s why anyone who really knows what is forex trading all about, spends a great deal of time devising a good money management system. In fact, money management is just as important as picking entry points in the market. Beyond that, there are some traders who have more than one account, utilizing different levels of leverage. They use one or the other, depending on the quality of the expected trade. Typically, short term traders need high leverage, much higher than long term traders who simply engage in investing in foreign currency. Nonetheless, one can find a balance, and use the same leverage for both concepts.

What is Forex Leverage to a Beginner?

Beginner traders are delusional about some aspects of forex trading, and what is forex leverage all about. Many of them want to use the highest possible leverage available. Thinking that more buying power will bring in more profits, and that their trading will be profitable from day one. But that rarely ever happens, most of them who use very high leverage end up blowing their accounts far too soon. This is because even tiny mistakes and misconceptions in trading, magnify into massive losses through leverage. And this relates back to overall account size and available funds in the bank account. If the trader doesn’t have a viable money management system in place, the funds can be lost in no time. So it’s best to start with no more than 100 to 1 leverage, and see how it goes before going any higher. Overall however, leverage is a good thing to have. Since it makes it possible for wise beginner traders to finally trade and profit from the markets in an affordable way. Especially in commodity trading, where it would have been way too costly to deal without leverage.