Online Contracts for Difference or CFD trading allows you to make profits due to changes in the prices of underlying financial instruments without actually owning them. This relatively new type of trading is gaining popularity because of the many advantages it provides.

The most profound advantage of online CFD Trading is that because you are only trading the difference between the purchase and sale (or sale and purchase) prices of an asset, you incur none of the brokerage fees associated with such a transaction – no “round-trip” commissions; only the margin spreads. The market trader enters into a contract with a CFD at a specific price, and the difference between that price and the price that it is closed at is settled in cash. (Note: A small fee is associated with holding positions over 24 hours, so CFDs are not appropriate for all longer-term investment strategies)

Discovering What Is online CFD Trading

Below we list some of the significant advantages of CFD trading.

1. Leverage plus margin

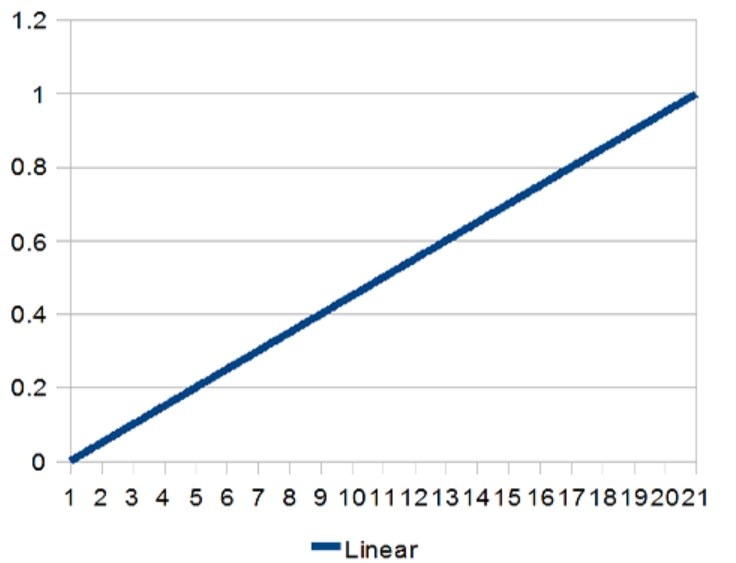

Leverage is the mechanism whereby your CFD margin deposit controls an asset of many times greater value, offering a magnified trading impact and accelerated return. The most significant advantage of online CFD trading is the unrivalled margin available in today’s platforms, with leverage of up to 400 to 1 (in forex).

Thus, a very small principal can control a significant trading amount, magnifying gains (and losses!). The implications of your decisions take on exponential importance. With this magnification ability comes a responsibility for better preparation and more professional execution. With this leverage ability across the entire range of asset classes, you can benefit from trading the entire set of asset classes with minimum committed capital.

2. Liquidity

CFD trading is a truly global enterprise. Trade initiation is possible if an official exchange is open for business somewhere on the globe. With forex, major commodities, and stock indices trading nearly 22–24/5, so are CFDs. And for commodities and shares listed only on US or European markets, trading hours are no less than in the underlying exchange. Fixed margins and best execution policies minimize unexpected “spikes”, even in fast moving markets. With CFDs, what-you-see is almost always what-you-get.

3. Tax and cost efficiency

Again, because CFDs are only agreements to compensate for price movements and not transactions involving asset ownership, their cost efficiency and style of taxation are also more advantageous. Levies associated with specific asset classes, like stamp taxes on shares are not imposed. The general exemption because no physical asset changes ownership can beneficially affect the relative tax and regulatory burdens as well.

As discussed above, the absence of a commission means that transaction costs are minimized. Furthermore, fixed costs are largely eliminated.

Similarly, the expensive costs and delays of a physical delivery of the shares, the registration, and any holding/safe custody charges that come with having a broker are eliminated, which saves you time and money.

4. Facility of automated orders and alerts

Today’s advanced CFD trading platforms offer a uniform interface for trading in all underlying assets. Additionally sophisticated alarms and trade prompts and executions ease your formulation and execution of standing orders to minimize losses and maximize profits.

5. Convenience of placing orders

A very important benefit of online CFD trading is that you can place your orders on multiple platforms and environments with one interface. Industry-leading companies offer 24/5 assistance and advance mobile-friendly environments. Seamlessly monitor your portfolio on smartphones, tablets and desktop PCs, depending on where you are. Trade anytime, anywhere.

6. Breadth of Offerings

In addition to the seamlessness of the interface and the general absence of commissions, the ability to trade a thousand or more financial instruments enhances the functionality of online CFD trading to the extent that they represent an optimal platform for a variety of hedging and risk management positions. For both traders with positions in any number of marketplaces and businessmen with exposure to underlying asset price fluctuation, having a single user-friendly multi-platform interface with position details reduces risk and overhead.

Now you can see the benefits of online CFD trading and why this type of trading is enjoying increasing popularity, particularly among those with modest funds available for trading.

CFD Online Trading Platform Specifics

While CFDs were initially publicly traded negotiable instruments on stock exchanges, their business model rapidly evolved and migrated into proprietary platforms wherein and whereby volume grew exponentially. Integral to this evolution was the explosion in computing power and the internet such that each current CFD marketplace is a closed platform backed by private capital. While national and supra-national financial regulators impose a veneer of respectability and oversight to the various operations, the business license threshold is minimal. Traders are thus required to perform their own due diligence in platform evaluation.

Evaluatory criteria include those both specific to CFDs and those more general related to trading environments. Apart from registration and any infraction information available from the regulatory authorities, enquire as to

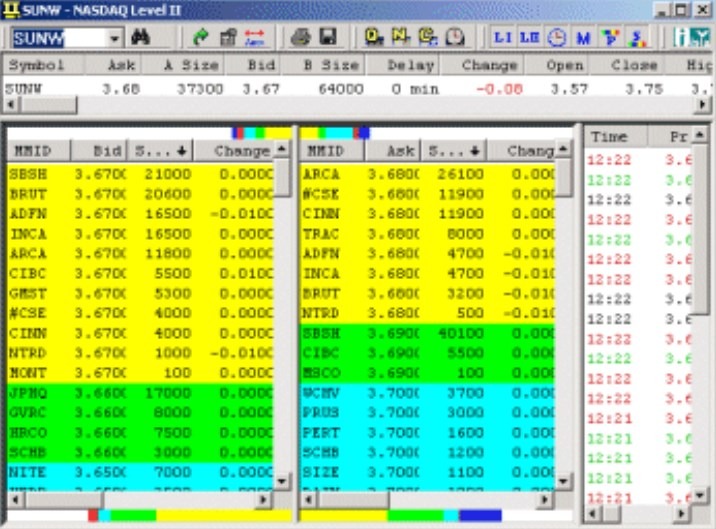

- Bid / Ask spread size and variability —The greater your trading velocity, the more important this variable will be to your performance. Often in online CFD trading, this variable is negotiable or a function of volume. Particularly here, clarify with brokers or sales representatives as to what special treatments are available and the criteria required to obtain them.

- Simulation account — Practice, practice, practice. Your online CFD trading platform should offer an unlimited environment in which you can try out your trading ideas and regimes and you should avail yourself of it. Contemporary psychology posits that 10,000 repetitions are required to master an autonomous action and while it can be readily agreed that playing piano and profitably “playing” markets are dissimilar skill sets, both require a degree of mental discipline and competence and the ability to learn from mistakes. Do not underestimate the demands of this element of preparation

- Customer Service and Responsiveness — After a thorough vetting of the prospective online CFD trading vendor and initial trading initiatives, both simulated and real, initiate and evaluate the firm’s customer service, across the entire range. Only after you have satisfied your expectations

- Ensure that order execution suffers minimal distortion. While total liquidity and instant position realization is not a reasonable expectation for a beginning retail trader, lags and price variance should be reasonable.

- Attempt to withdraw funds. Regulatory anti-money-laundering laws have rendered the withdrawal process into a more stringent and drawn out process, but once you have submitted the correct documents, your second and subsequent requests should be routine prompt affairs.

- Ask difficult questions and make demands. Confirm that “24/5” availability is truly the case. Ensure that promised responsiveness extends to all communication channels: for example, phone, email, website, instant messaging

- Quality of Ancillary Assistance — With the information technology explosion and internet revolution has come the ability to calculate and present endless analyses of data, from streaming news feeds to market commentary, charting packages, and alerts of varying kinds. Your platform should offer a wealth of such tools and the ability to package, deliver and format them as per any individual preference.

- Instrument leverage — The multiple of your margin capital. This magnification factor is actually less important than other platform characteristics because new traders in particular over-leverage their capital. Just as in the larger business world, most business fail, with the single largest contributing factor under-capitalization; Most new traders fail, with the single largest cause being over-leveraged positions. As a beginning trader, no single trade should represent more than 2% of your “risk capital” (defined as monies which can be lost in their entirety) and ultimately this percentage can be increased to five percent.