Bitcoin price hit new highs as a stablecoin liquidity metric pointed to fresh capital flowing into BTC. Retail investor inflows dropped while Binance’s market share surged past 49%, highlighting institutional investors’ role in driving the rally.

Bitcoin price hit new highs as a stablecoin liquidity metric pointed to fresh capital flowing into BTC. Retail investor inflows dropped while Binance’s market share surged past 49%, highlighting institutional investors’ role in driving the rally.

The U.S. dollar’s share of global currency reserves reported to the International Monetary Fund nudged lower to 57.7% in the first quarter of 2025 while the share of euro-denominated reserves gained, International Monetary Fund data showed.

Gold prices edged up as investors closely watched negotiations between the United States and its trading partners, while a firmer dollar capped further gains.

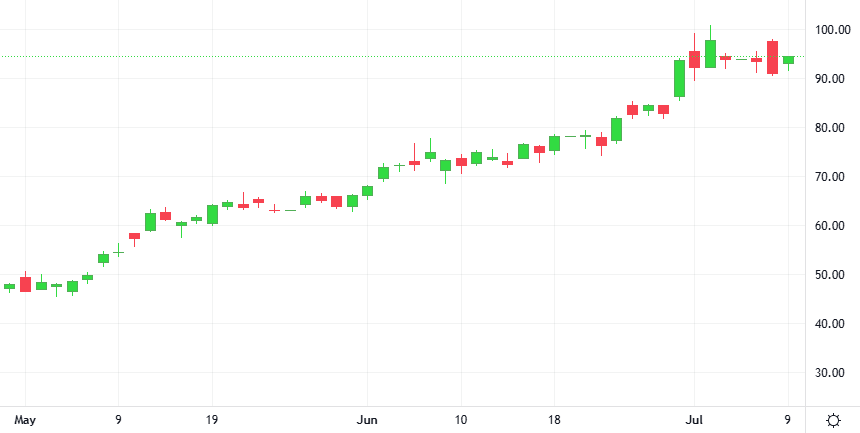

Robinhood’s strategic embrace of blockchain technology and tokenization has fueled a nearly 30% rally in its stock over the past month, highlighting the brokerage’s new growth drivers despite regulatory scrutiny of some of its products.

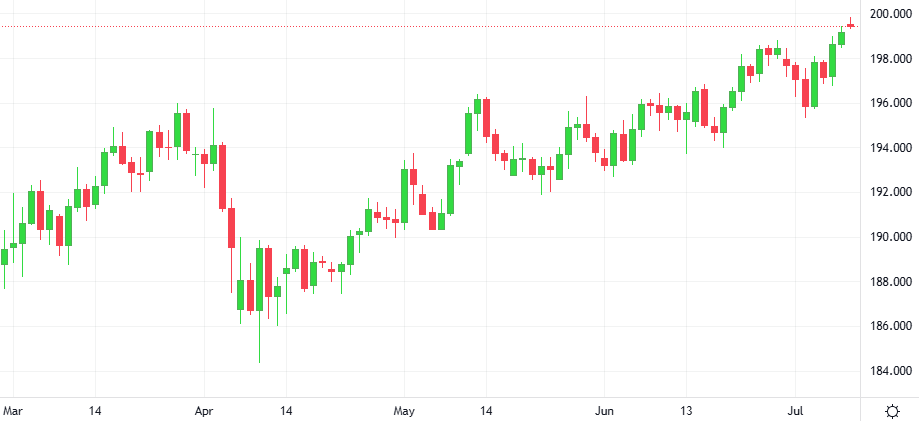

The pound rose, gaining against the likes of the yen after the U.S. announced 25% tariffs on imports from Japan and South Korea, as investors gravitated towards markets that are at less risk of being hit by hefty duties

U.S. President Donald Trump said he plans to announce tariffs on imported semiconductors and pharmaceuticals, saying the rate for medicines could reach 200% but he would give drugmakers about one year “to get their act together.”