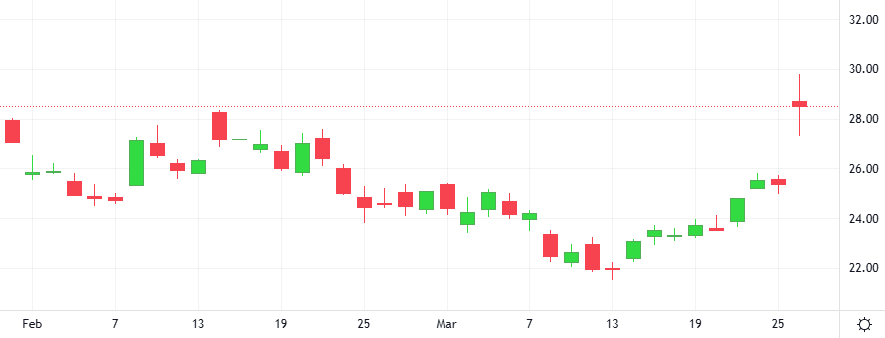

A rocky U.S. stock market will be tested in the coming week by a pivotal deadline for President Donald Trump’s tariff plans and an employment report that could reveal a slowing economy. The S&P 500 posted a weekly loss, selling off on Friday after data pointed to underlying price pressures.