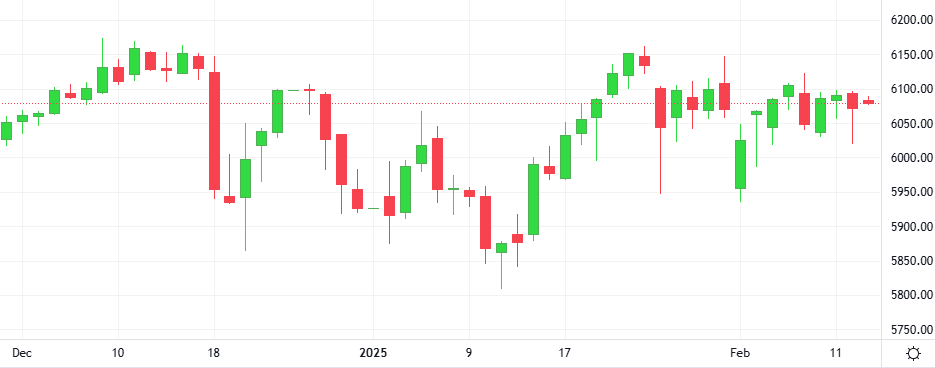

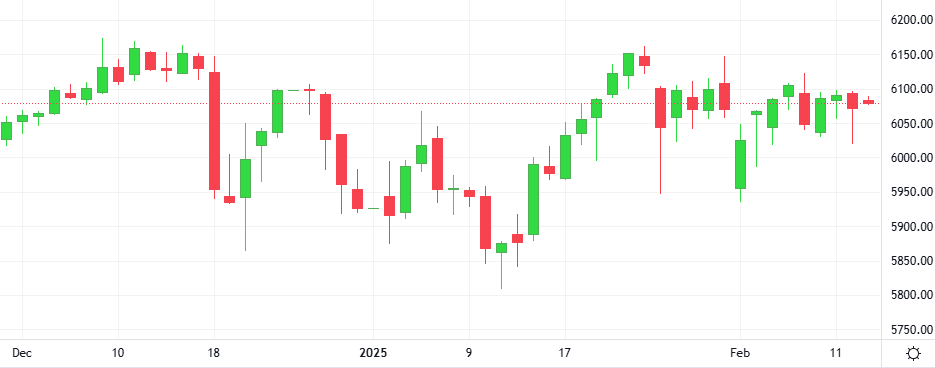

The S&P 500 dipped as a hotter-than-expected U.S. inflation reading added to worries that the Federal Reserve would not cut interest rates anytime soon, while CVS Health and Gilead Sciences rallied after upbeat quarterly reports

The S&P 500 dipped as a hotter-than-expected U.S. inflation reading added to worries that the Federal Reserve would not cut interest rates anytime soon, while CVS Health and Gilead Sciences rallied after upbeat quarterly reports

Circle’s USD Coin reached a $56.3 billion market capitalization, erasing the losses it sustained during the most recent bear market. The $56.3 billion market cap represents a 23.4% increase from the $45.6 billion measured on January 8th. The lowest market cap USDC reached during the bear market was $24.1 billion in November 2023.

Oil prices rebounded despite lingering fears over a potential global trade war after U.S. President Donald Trump’s latest tariff plans, this time targeting steel and aluminium.

The Oil-Dollar pair exploded 1.5% in the last session. According to the Stochastic-RSI, we are in an overbought market.

Support: 69.899 | Resistance: 73.86

Gold prices continued their record rally on Monday and broke through the key $2,900 level for the first time, driven by safe-haven demand as U.S. President Donald Trump’s new tariff threats amplified trade war and inflation concerns.

The Gold-Dollar pair exploded 1.2% in the last session. The Ultimate Oscillator is giving a positive signal.

Support: 2831.6 | Resistance: 2968.4

The U.S. dollar fell to its lowest in more than a week as investor nerves about a global trade war abated, while the Japanese yen rallied on the back of strong wage data. Euro rose slightly after dropping to start the week.

Gold prices continued their record run, as investors sought the safe-haven asset amid escalating concerns about a U.S.-China trade war and the potential impact on economic growth.

The Gold-Dollar pair exploded 1.0% in the last session. The ROC is giving a positive signal.

Support: 2798.8 | Resistance: 2926.3