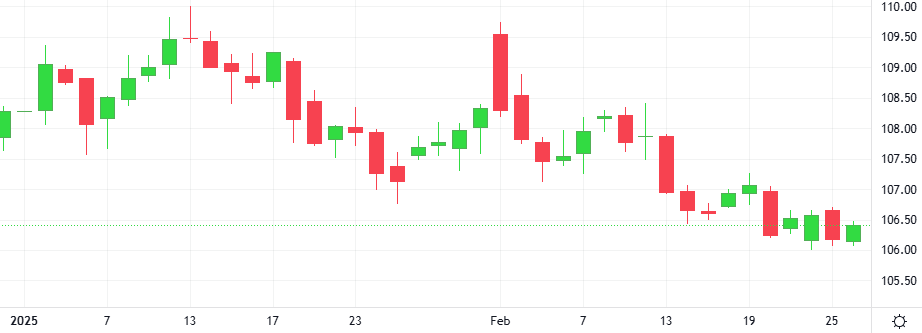

China’s manufacturing activity expanded at the fastest pace in three months in February as new orders and higher purchase volumes led to a solid rise in production, an official factory survey showed. The official purchasing managers’ index rose to 50.2 in February.