European shares rose to record levels, led by defence stocks, as the region’s political leaders called for an emergency summit on the Ukraine war amid growing U.S. calls to boost military spending for security.

European shares rose to record levels, led by defence stocks, as the region’s political leaders called for an emergency summit on the Ukraine war amid growing U.S. calls to boost military spending for security.

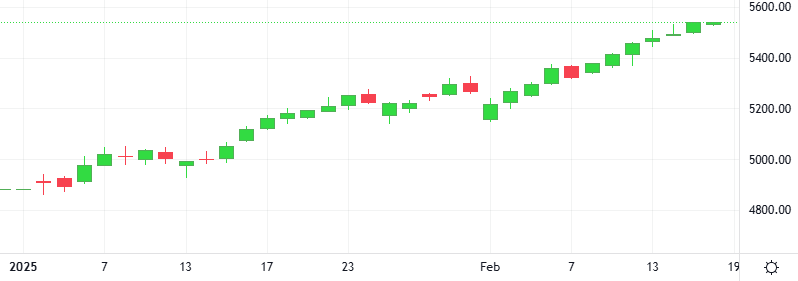

Oil prices were broadly steady as investors monitored developments over a possible Russia-Ukraine peace deal that could increase global flows by easing sanctions, while reduced Caspian supply from a pumping station drone attack curbed any selling.

The Oil-Dollar pair skyrocketed 1.3% in the last session. The RSI is giving a negative signal.

Support: 69.539 | Resistance: 72.72

The United States Securities and Exchange Commission has requested an additional 28 days to review crypto exchange Coinbase’s appeal in its ongoing lawsuit. However, the agency says its new crypto division could potentially end the 20-month legal battle.

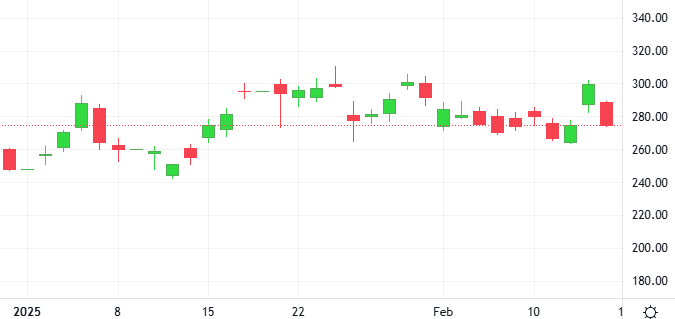

The dollar notched a weekly loss against the euro as a delay in the introduction of trade tariffs planned by U.S. President Donald Trump raised hopes that they may not be as bad as feared, while optimism about a peace deal between Russia and Ukraine helped the single currency rally.

The Euro-Dollar pair made a minor upwards correction in the last session, rising 0.2%. The Stochastic-RSI indicates an overbought market.

Support: 1.0383 | Resistance: 1.0591

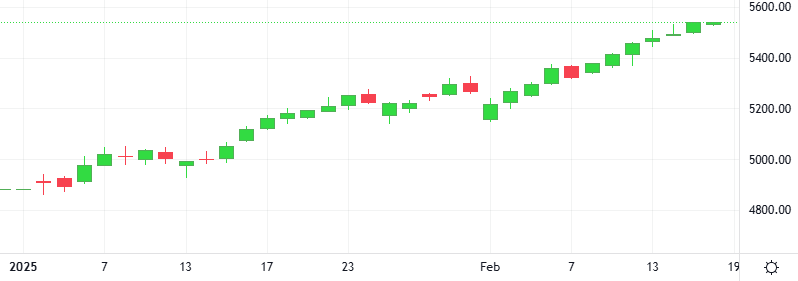

Walmart’s quarterly report in the coming week will give investors fresh insight into the health of U.S. consumers, who are facing stronger inflation and uncertainty over whether President Donald Trump’s tariffs will push up prices. The benchmark S&P 500 stock index was up about 1% last week, with stocks showing resilience.

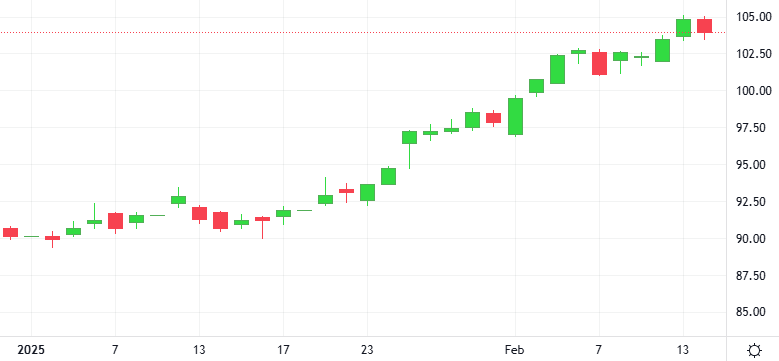

Gold prices climbed due to escalating concerns about U.S. President Donald Trump’s impending tariff plans, which could further strain global trade relations. Trump plans to impose reciprocal tariffs on countries that levy duties on U.S. imports.

The last session saw the Gold rise 0.3% against the Dollar. The Stochastic indicator indicates an overbought market.

Support: 2884.7 | Resistance: 2959.4