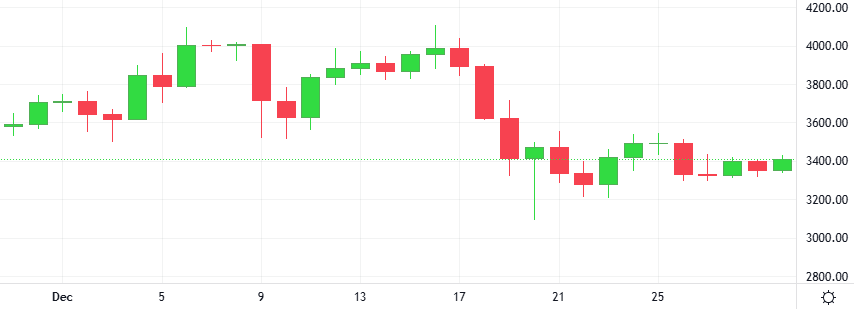

Taiwan’s Foxconn, the world’s largest contract electronics maker, beat expectations to post its highest-ever revenue for the fourth quarter on continued strong demand for artificial intelligence servers. Revenue for Apple’s biggest iPhone assembler jumped 15.2% to $64.72 billion.