Investors will focus in the coming week on whether inflation trends can help sustain the record-breaking stock rally that has received a boost from Donald Trump’s victory in the U.S. presidential race. The benchmark S&P 500 surged to an all-time high and hit the 6,000 level for the first time.

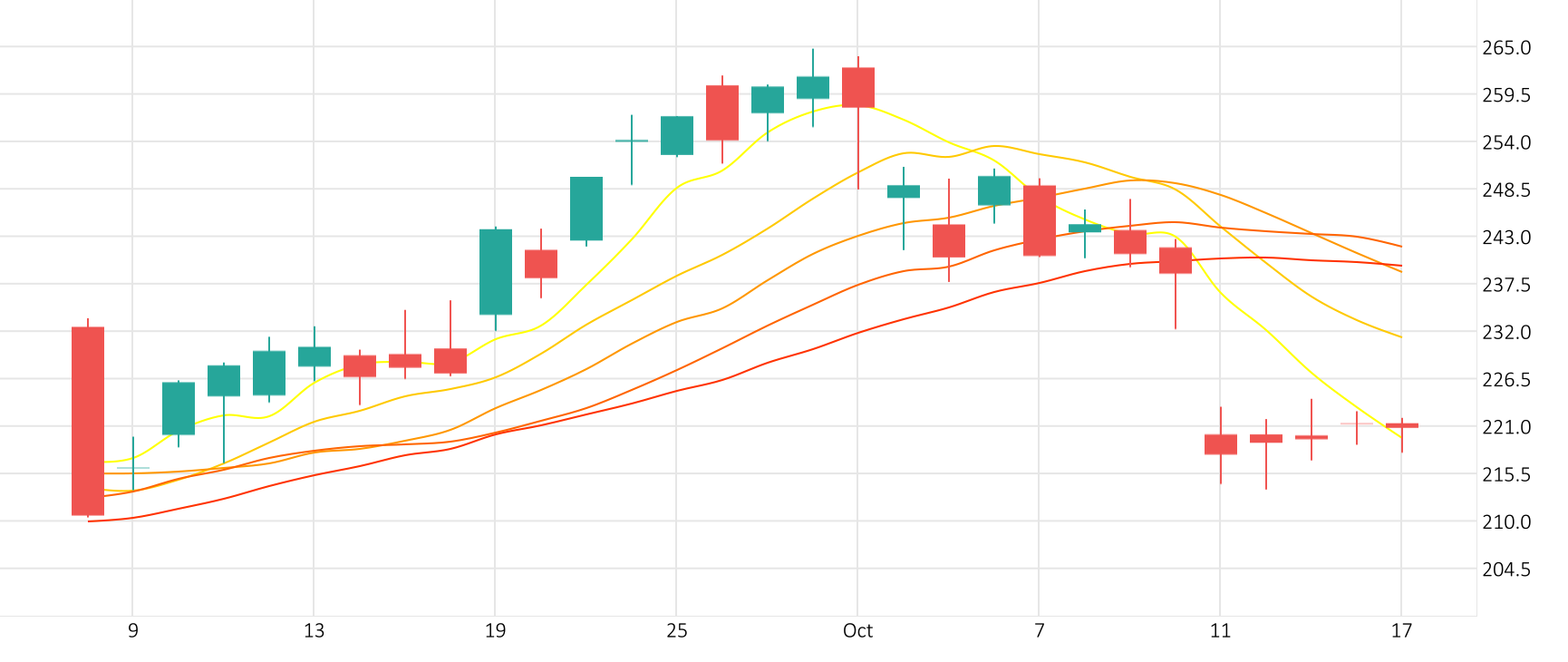

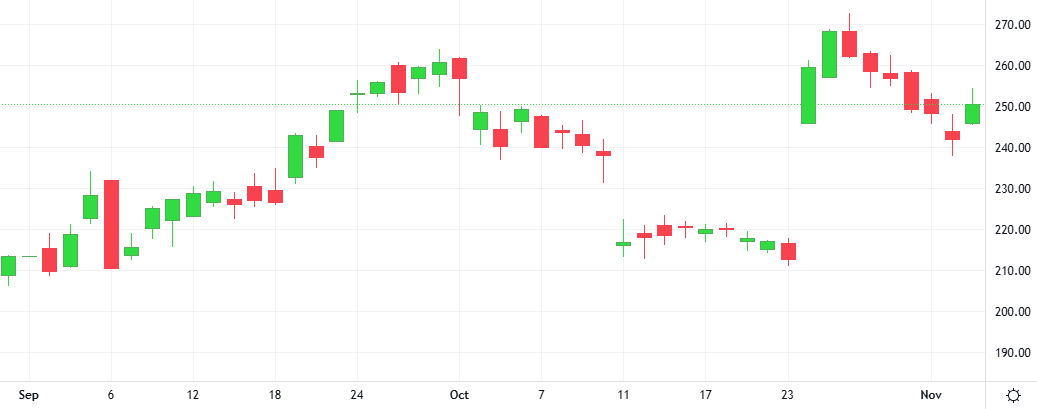

The Bitcoin-Dollar pair exploded 4.6% in the last session. The ROC is giving a positive signal.

BTC/USD exploded 4.6% in the last session.

Support: 73577 | Resistance: 86402