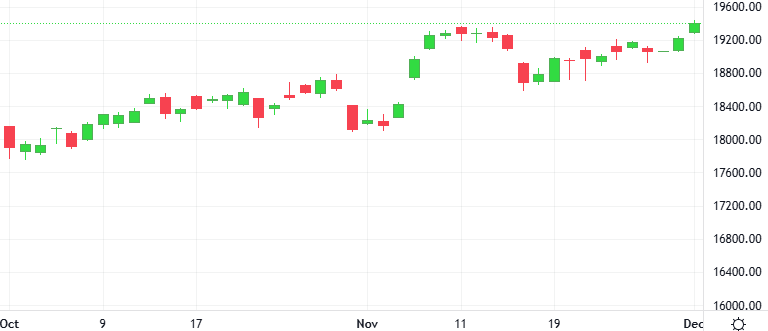

OPEC oil output rose for a second month in November as Libya’s production recovered after resolution of a political crisis, though members making cuts pledged to the wider OPEC+ alliance kept output broadly steady.

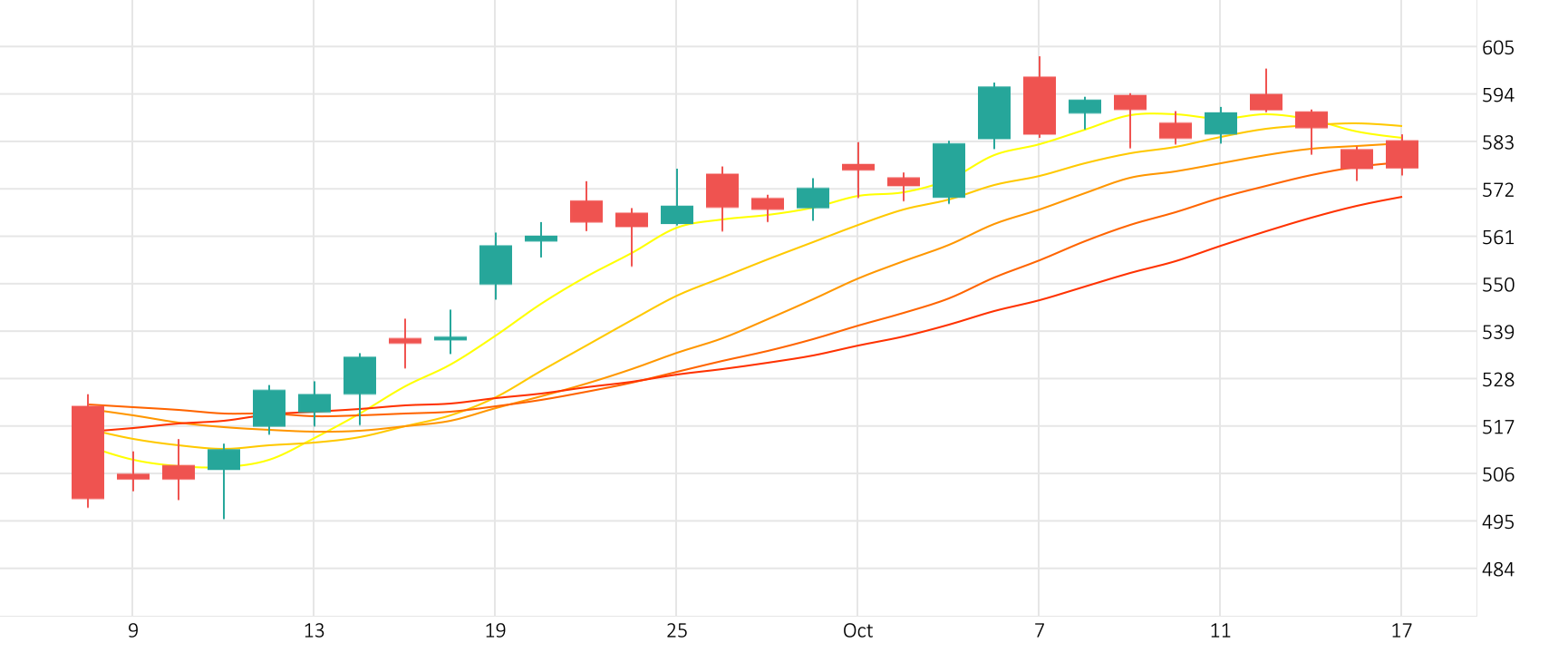

The Oil-Dollar pair exploded 2.4% in the last session. The Ultimate Oscillator is giving a positive signal.

Support: 66.191 | Resistance: 72.881