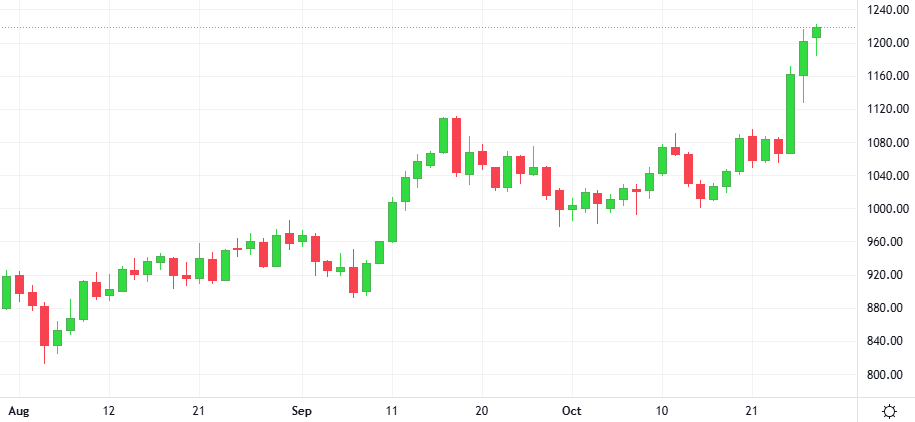

Digital asset inflows experienced a notable surge in the week ending October 25th, reaching $901 million, largely fueled by a spike in Bitcoin transactions and propelling year-to-date totals to $27 billion.

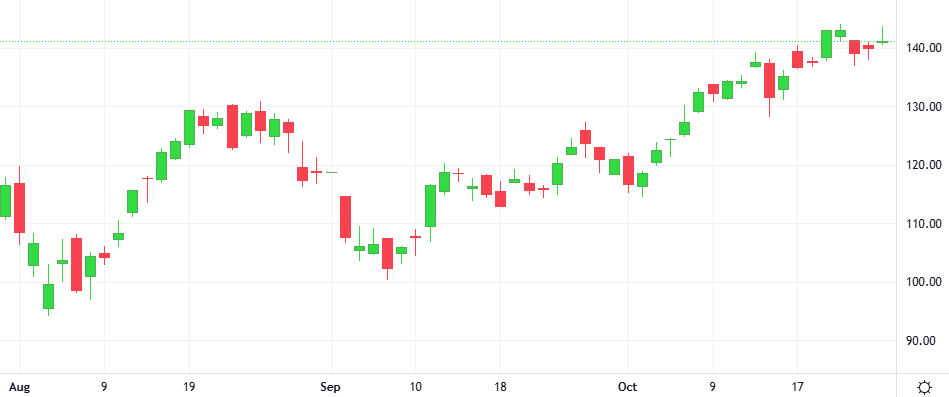

The Bitcoin-Dollar pair exploded 1.3% in the last session. The ROC is giving a negative signal.

Support: 66566 | Resistance: 71486