The Canadian dollar strengthened to a five-month high against its U.S. counterpart as oil prices rose and major railroad operators focused on restoring service. The loonie traded 0.3% higher, after rising 0.8% to end previous week.

The Canadian dollar strengthened to a five-month high against its U.S. counterpart as oil prices rose and major railroad operators focused on restoring service. The loonie traded 0.3% higher, after rising 0.8% to end previous week.

Cryptocurrency investors have been increasingly purchasing Bitcoin -related exchange-traded products amid concerns over potentially looming interest rate cuts in September. Digital asset investment products saw weekly inflows worth $533 million from August 18th to 24th

Nvidia is likely to report that its second-quarter revenue more than doubled. But investors used to its blockbuster results will be expecting even more from the artificial intelligence chip giant, as any miss on expectations could hurt companies shares.

The U.S. Federal Reserve’s dovish shift will likely give the Bank of Japan some respite in its battle to tame a weak yen, but could complicate its efforts to raise interest rates if the two central banks’ diverging policy paths keep markets jittery.

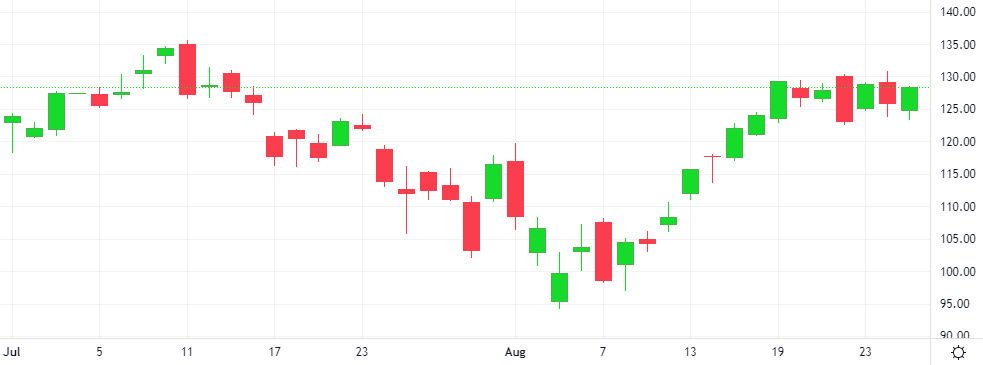

The Dollar-Yen pair traded sideways in the last session. The MACD is giving a positive signal.

Support: 142.5233 | Resistance: 147.4233

The dollar fell and sterling rose to its highest in more than two years on Friday after Federal Reserve Chair Jerome Powell gave an unambiguous signal that the long-anticipated U.S. interest rate cut would come next month.

The Pound-Dollar pair traded sideways in the last session. According to the Stochastic-RSI, we are in an overbought market.

Support: 1.3029 | Resistance: 1.3322

The rally in U.S. stocks faces an important test next week with earnings from chipmaking giant Nvidia, whose blistering run has powered markets throughout 2024. The S&P 500 has pared a sharp drop it suffered after U.S. economic worries contributed to a sell-off at the beginning of the month.