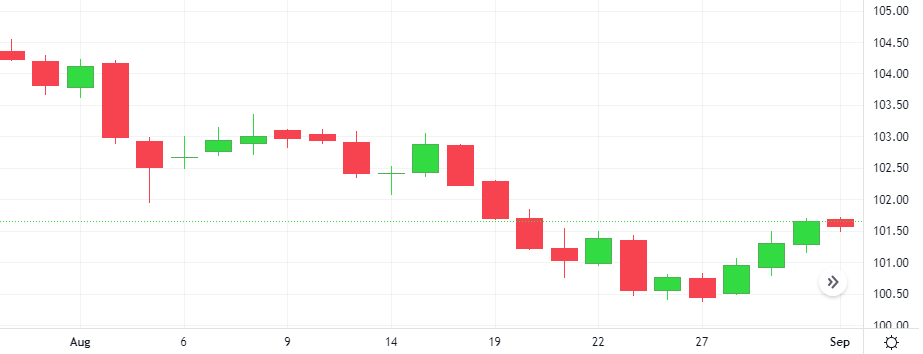

Sales of U.S. automaker Tesla’s China-made electric vehicles grew 3% in August from a year earlier, data from the China Passenger Car Association showed. Deliveries of its China-made Model 3 and Model Y vehicles rose 17% from July.

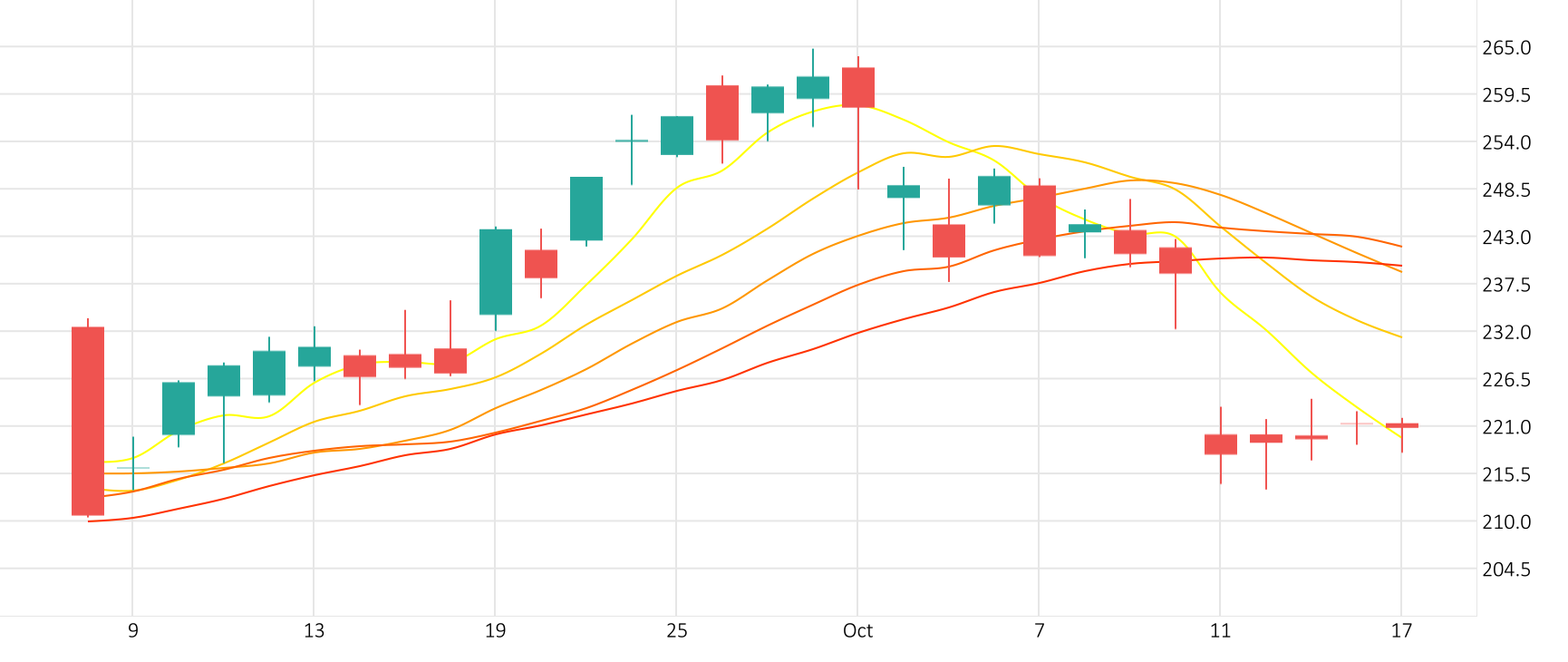

Tesla shares gained 2.6% in the last session. The RSI is giving a positive signal.

Tesla shares rose 2.6% in the last session.

The RSI is currently in the positive zone.

Support: 200.1267 | Resistance: 217.9667