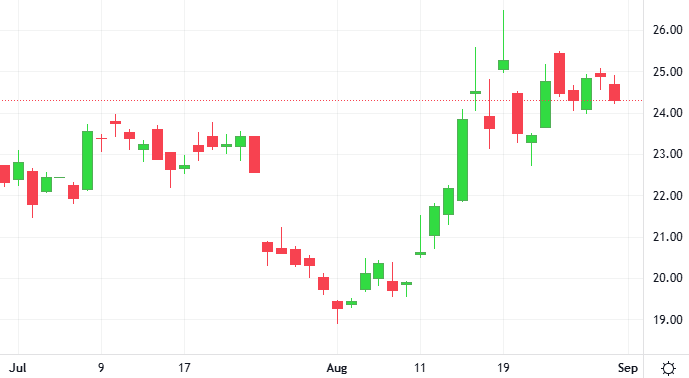

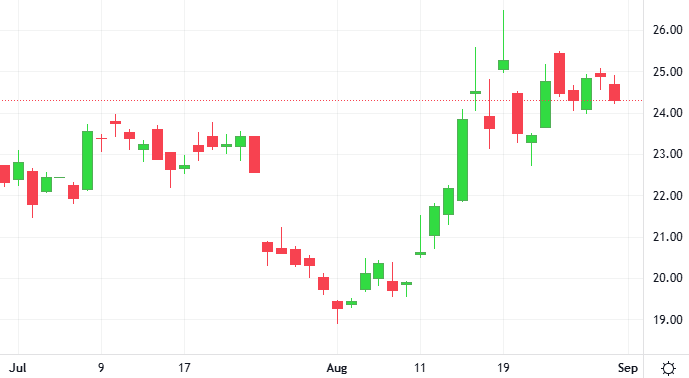

Intel said it amended the CHIPS Act funding deal with the U.S. Department of Commerce to remove earlier project milestones and received about $5.7 billion in cash sooner than planned. The move will give Intel more flexibility over the fund

Intel said it amended the CHIPS Act funding deal with the U.S. Department of Commerce to remove earlier project milestones and received about $5.7 billion in cash sooner than planned. The move will give Intel more flexibility over the fund

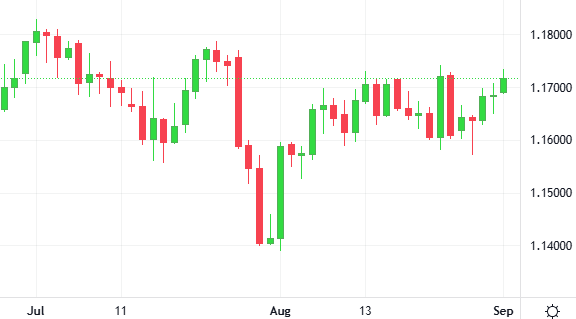

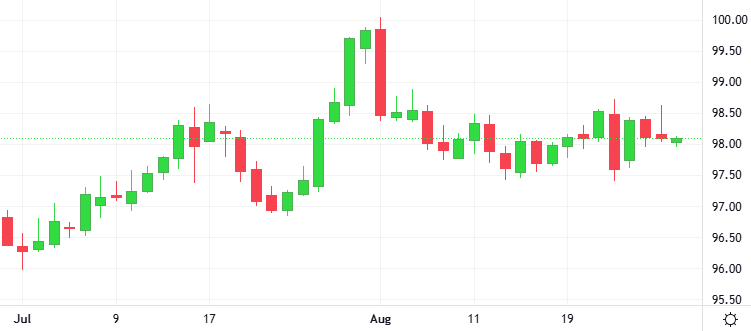

The dollar weakened against the euro and Swiss franc to end last week, on course for a 2% decline in August against a basket of currencies, as traders prepared for a U.S. interest rate cut by the Federal Reserve next month.

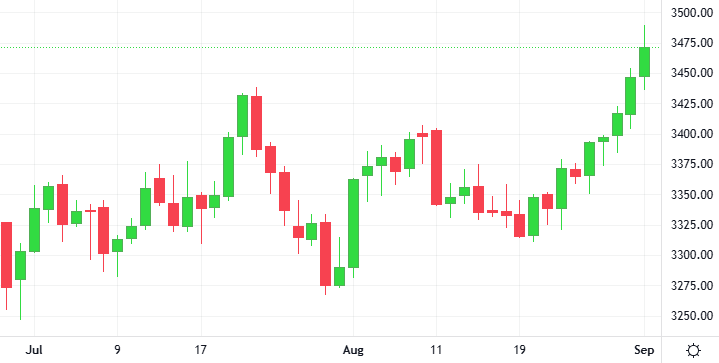

Gold prices rose around 1% and were poised for their best monthly performance since April, as U.S. inflation data reinforced expectations that the Federal Reserve could cut interest rates next month.

On Tuesday, Trump Media and Technology Group announced launching a joint $6.4 billion Cronos treasury with Crypto.com and Yorkville Acquisition. Cronos, the native cryptocurrency of the Crypto.com-backed Cronos Chain, surged to multi-year highs following news of the Trump Media Group CRO Strategy launch.

The dollar rose against major currencies, rebounding from yesterday’s pullback as investors turned their focus to upcoming U.S. economic data for policy cues, even as worries persist over the Federal Reserve’s independence.

ByteDance, the owner of short-video app TikTok, is set to launch a new employee share buyback that will value the Chinese technology giant at more than $330 billion, driven by continued revenue growth that surpassed giants like Meta