Demand for Bitcoin has been in a downtrend since April, approaching negative levels over the past few weeks. According to data analytics firm CryptoQuant, the apparent demand for the digital asset has dropped from a 30-day growth of 496,000 Bitcoin in April to a current negative growth of 25,000 BTC.

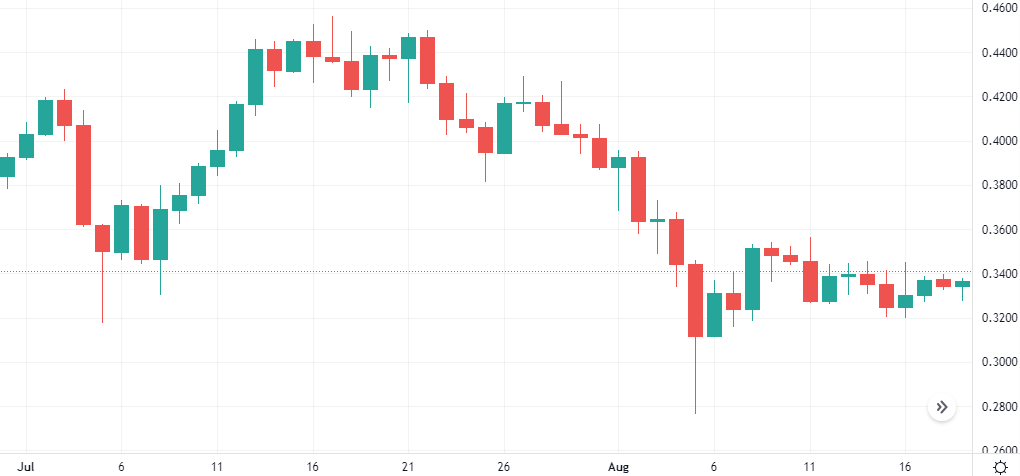

The Bitcoin-Dollar pair fell 0.6% in the last session. According to the Stochastic-RSI, we are in an overbought market.

BTC fell 0.6% against USD in the last session.

The Stochastic-RSI points to an overbought market.

Support: 57343.6667 | Resistance: 60831.6667