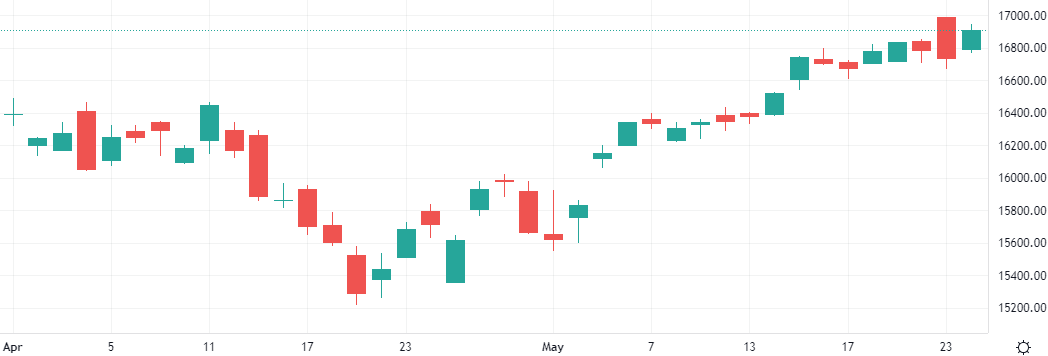

U.S. stocks rebounded on Friday from sharp losses the day before on news of an improving consumer outlook on inflation, sending the Nasdaq to a fifth straight week of gains and record closing high.

U.S. stocks rebounded on Friday from sharp losses the day before on news of an improving consumer outlook on inflation, sending the Nasdaq to a fifth straight week of gains and record closing high.

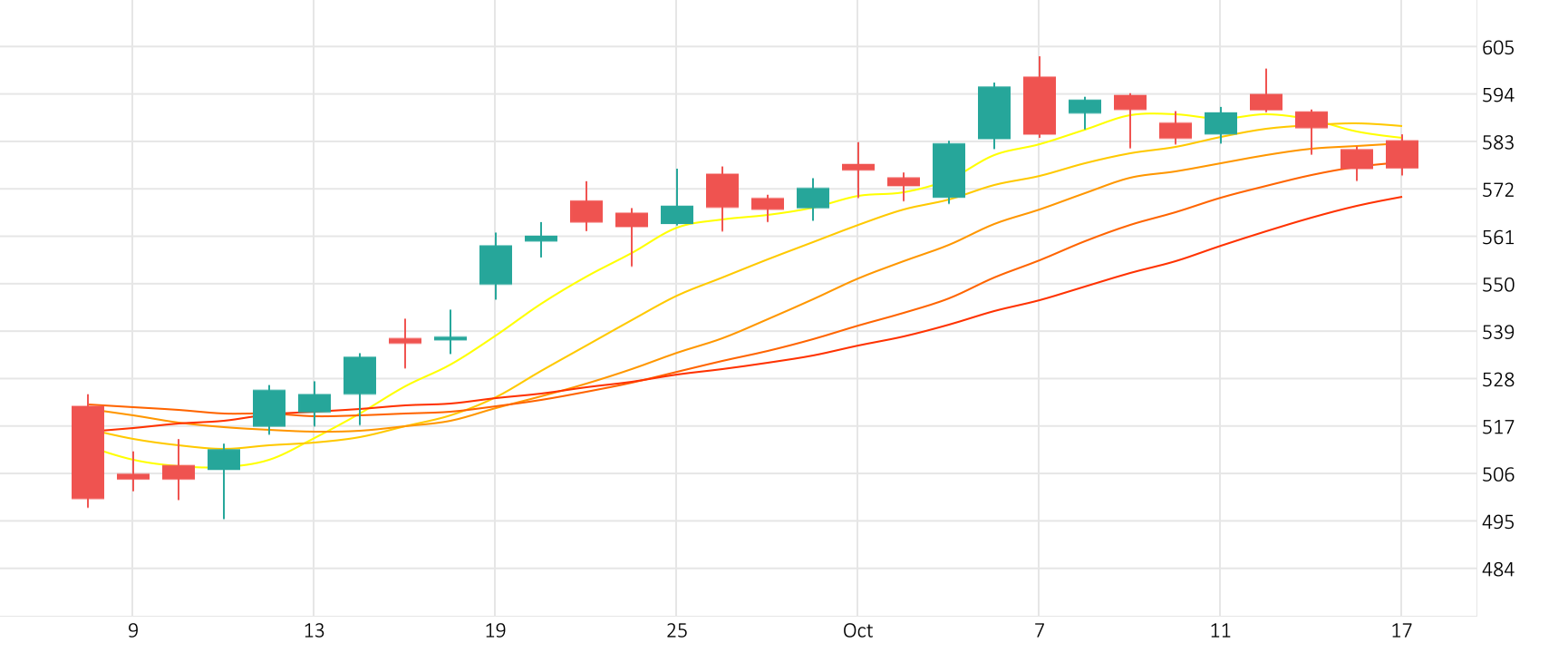

Whales Inject $2 Billion Within 5-Days of ETF Approval. Ethereum price surged above $3,850 twice in the last 48-hours, as bullish investors front-run influx of funds into the newly-approved ETH spot ETFs.

Coinbase’s chief legal officer, Paul Grewal, announced that customers in the state of New York could once again trade XRP on the crypto exchange after a nine-month hiatus.

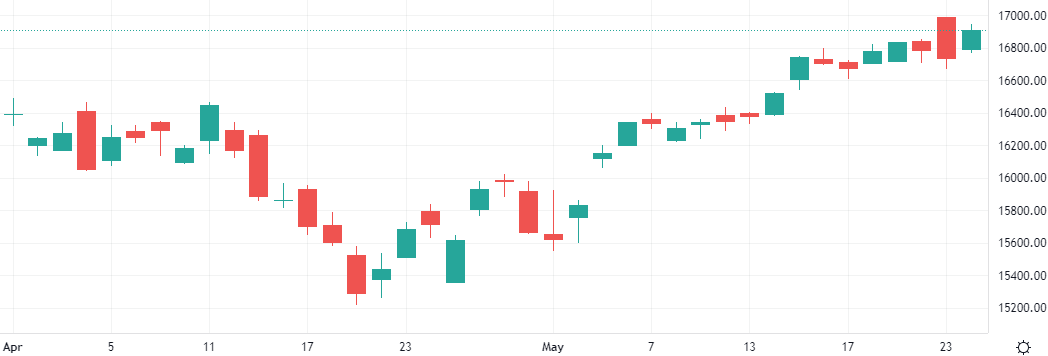

Meta shares gained 2.2% in the last session. The CCI is giving a positive signal.

Meta’s stock gained 2.2% in the last session.

The CCI is giving a positive signal.

Support: 454.4079 | Resistance: 480.0441

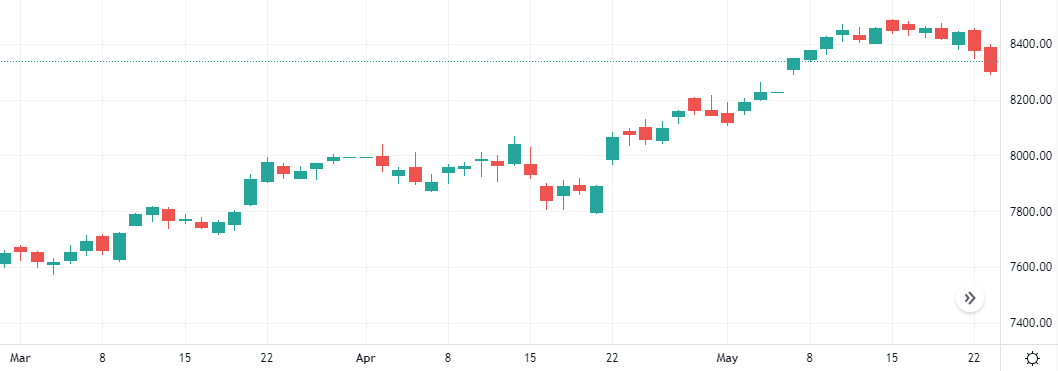

The last session saw the Silver rise 0.7% against the Dollar. The MACD is giving a positive signal.

XAG/USD gained 0.7% in the last session.

The MACD is giving a positive signal.

Support: 29.4511 | Resistance: 31.3209

The UK’s main stock indexes closed lower for a third consecutive session amid political uncertainty ahead of UK’s elections in July, while news of slower growth across businesses in May weighed on sentiment.