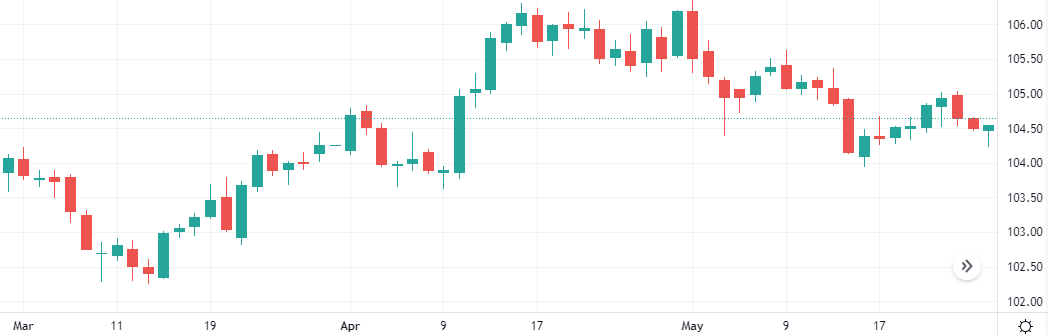

The Canadian dollar weakened against its U.S. counterpart as concern that central banks could leave interest rates at elevated levels longer than previously thought raised demand for the safe-haven greenback.

The Canadian dollar weakened against its U.S. counterpart as concern that central banks could leave interest rates at elevated levels longer than previously thought raised demand for the safe-haven greenback.

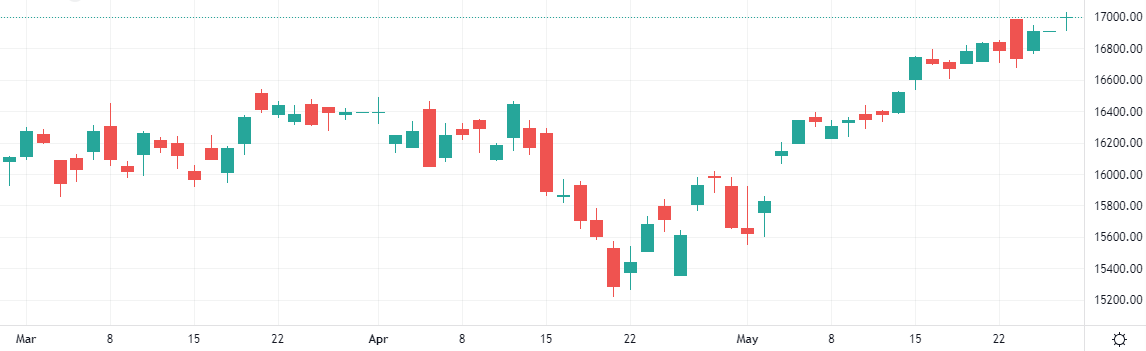

The Nasdaq crossed 17,000 for the first time ever, boosted by gains in Nvidia, while the S&P 500 closed slightly higher and the Dow slightly lower as Treasury yields rose. Nvidia shares boosted shares of other chip stocks as traders returned from a holiday-extended weekend.

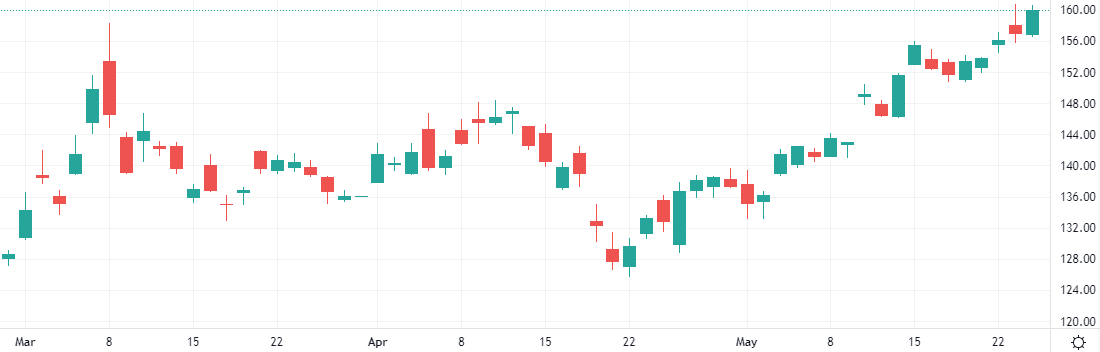

Apple’s share price rose over 10% in May, rebounding after four months of underperformance.

In April 2024, iPhone sales surged by 52% year-over-year.

Key Drivers of the Sales Boom:

New Product Launches

Improved Supply Chain

Increased Marketing Efforts

5G Expansion

What’s Next for Apple?

Apple will focus on innovation and customer satisfaction, with upcoming product launches, AR advancements, and new tech entries like wearables and smart home devices.

Apple’s AI Strategy

Apple signed a deal with OpenAI to integrate ChatGPT into iOS 18, while still offering Google as an AI option. This strategy leverages advanced AI technologies and maintains ecosystem flexibility.

Conclusion:

Apple’s 52% iPhone sales increase in April reflects strategic development, effective supply chain management, and market strength. Continued innovation will keep Apple a key industry player.

The dollar gained, giving back earlier losses, as benchmark U.S. Treasury yields hit a four-week high following some weak auctions. The Treasury Department saw soft demand for sales of two-year and five-year notes.

Oil prices gained more than $1 a barrel on the expectation that OPEC+ will maintain crude supply curbs at its June 2 meeting, while the start of U.S. summer driving season and a weaker dollar also boosted the commodity.

The Oil-Dollar pair skyrocketed 2.1% in the last session. The Ultimate Oscillator is giving a positive signal.

Support: 77.651 | Resistance: 79.771

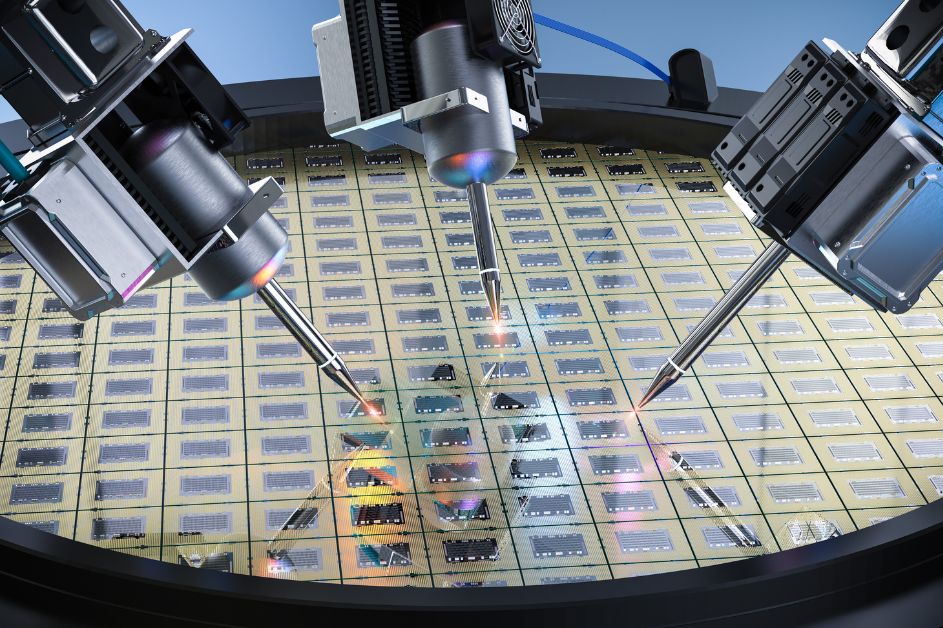

Taiwan Semiconductor Manufacturing (NYSE: TSM), a global leader in the semiconductor industry, saw its stock price rise by 1.9% last Friday to close at $160, driven by growing enthusiasm for artificial intelligence advancements.

Quarterly Earnings Report

On April 18th, TSMC announced an impressive performance for the first quarter of 2024, with a significant 8.9% year-on-year increase in net profit. The company reported a net profit of NT$225.49 billion (US$6.96 billion) for Q1, bolstered by its highest-ever first-quarter sales of NT$592.64 billion, a 16.5% increase from the previous year.

TSMC’s robust results are attributed to strong demand for its advanced semiconductor processes, essential for emerging technologies such as artificial intelligence and high-performance computing (HPC). This demand has effectively mitigated the downturn in the global smartphone market.

Advanced Process Technology

TSMC’s cutting-edge technology continues to lead the market, with its 3nm process accounting for 9% of Q1 sales, the 5nm process making up 37%, and the 7nm process representing 19%. These advanced processes contributed to 65% of TSMC’s total sales in the first quarter.

Looking Ahead

As TSMC continues to innovate, it is also preparing to launch its 2nm process in 2025, further cementing its position at the forefront of semiconductor manufacturing.

In summary, TSMC’s strong financial performance and ongoing advancements in semiconductor technology position the company well for future growth, despite facing some sector-specific challenges.