Gold prices soared as investors flocked to safe-haven assets following Israeli airstrikes on Iran, re-igniting fears of a broader conflict in the Middle East. U.S. gold futures settled 1.5% higher.

Gold prices soared as investors flocked to safe-haven assets following Israeli airstrikes on Iran, re-igniting fears of a broader conflict in the Middle East. U.S. gold futures settled 1.5% higher.

Oil prices jumped on Friday and settled higher as Israel and Iran traded air strikes, feeding investor worries that the combat could widely disrupt oil exports from the Middle East. Both benchmarks had their largest intraday moves since 2022 when Russia’s invasion of Ukraine caused a spike in energy prices.

Dual risks kept investors on edge ahead of markets reopening, from heightened prospects of a broad Middle East war to U.S.-wide protests against U.S. President Donald Trump that threatened more domestic chaos.

The dollar has sunk to its lowest in three years as rapidly changing U.S. trade policy unsettles markets and expectations build for Federal Reserve rate cuts, fuelling outflows from the world’s biggest economy.

Gold prices scaled a one-week peak, steered by simmering Middle East tensions and cooler U.S. economic data that fuelled fresh bets on Federal Reserve rate cuts. U.S. gold futures settled 1.8% higher .

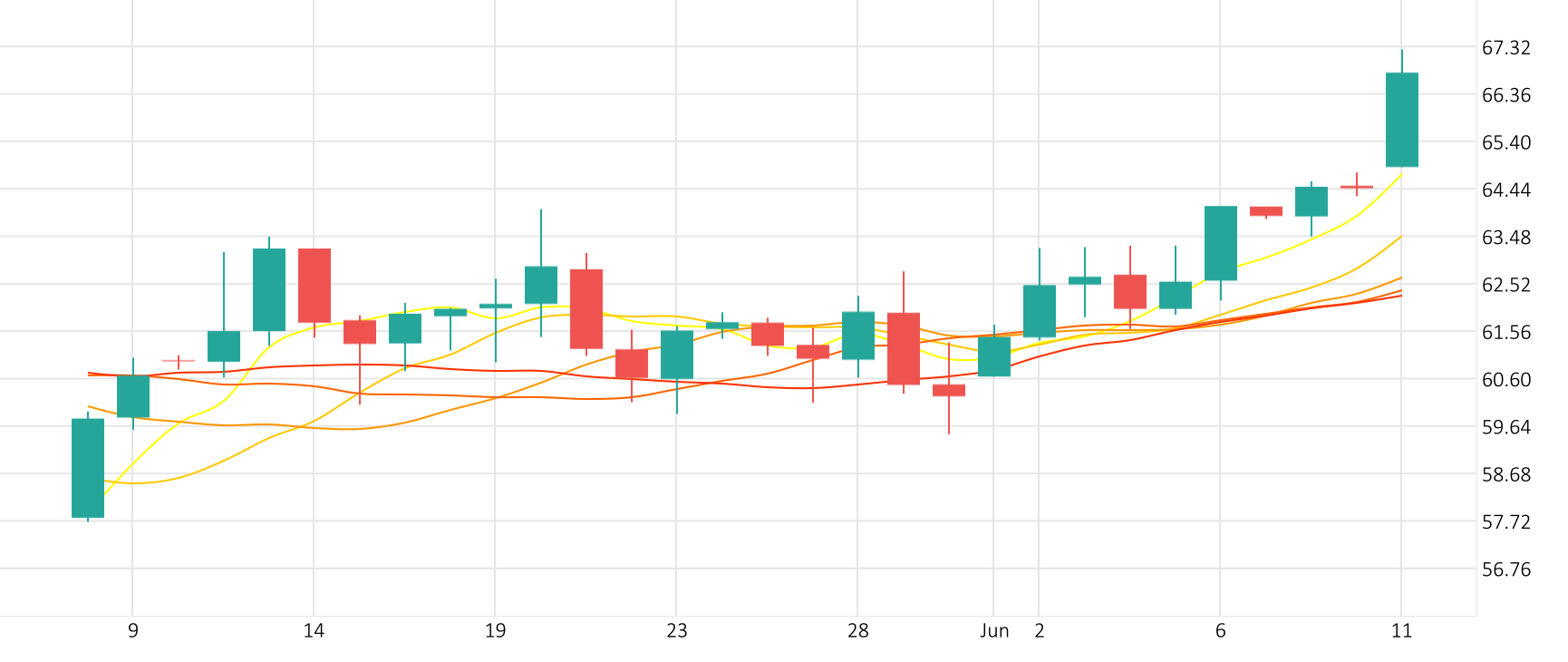

The Gold-Dollar pair gained 1.0% in the last session after a 1.1% intra-session dip. The CCI indicates an overbought market.

Support: 3345.6 | Resistance: 3510.2

U.S. President Donald Trump said he would not fire Federal Reserve Chair Jerome Powell, adding that he “may have to force something” as part of his ongoing push for the central bank to lower rates.