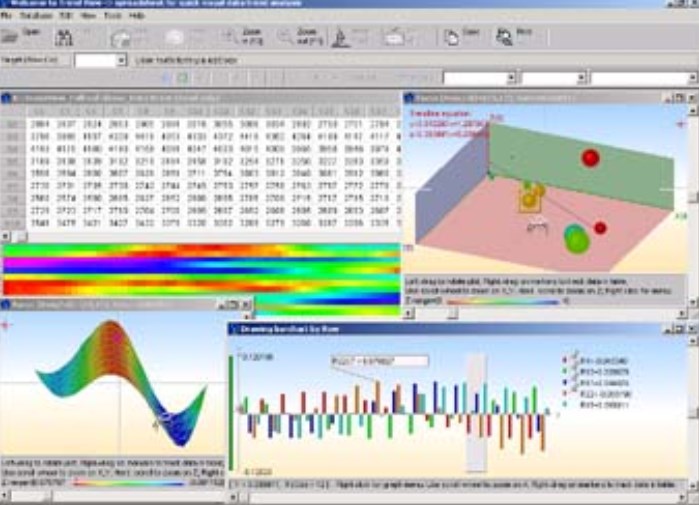

CFDs are unique in many ways, and wise traders use them to lower the risk in all kinds of trades and investments. Even the world’s best, most sophisticated stock Option traders use CFDs in the most directional part of their trades. Because it makes calculations easier, and cost is also less as opposed to an all Options based trade. These wise traders do use CFD trading software, which is nothing more than a spreadsheet calculator, or something just as powerful. There is no need for any other CFD trading software. But don’t be fooled, even basic trades can get a little complicated. The trader has the task of modeling risk, against market volatility, pivotal market levels, and fine-tuning the size of the CFD trades. And when it comes to risk control and fine-tuning variables, even tiny changes can have a dramatic impact on the outcome. The purpose of the CFD trade is to either make a profit, outright. Or to hedge risk on another trade. But this could involve a series of multiple trades, and more complicated adjustments on the size of each of the CFD trades. And volatility has a lot to do with it. So as you can imagine, trading is not as simple as up or down, and adjusting outright or hedging trades can get quite complicated. That’s why a spreadsheet analysis can provide great insights, and help simulate a series of trading days. Some impressive CFD trading systems are based on spreadsheet analysis. The simulation is only semi-automated, as the trader can change the values of variables in any cell, directly. And this is even better than fully automated software where the user is restricted from testing various what-if scenarios. Volatility is well known to institutional Option traders, but now even retail CFD traders can take a closer look at this hidden dimension of the markets. Good CFD trading signals can be inferred from volatility alone. And profiting from these trades through CFDs is more direct, less complicated, and more accurate than any other instrument can offer.

A Spreadsheet as Your CFD Trading Software

Your CFD trading software should provide quick answers to various questions. Questions on volatility analysis and how the rest of the market, stocks or currencies, can react to that volatility change. So for example, if the volatility of crude oil moves too much in one direction steadily, say up. This means that the perceived risk of crude oil going much lower or much higher, is steadily increasing, and therefore the risk of USDCAD going up or down is also increasing. But USDCAD may not go up or down steadily, but rather trade deceptively for days, and then have one or moere big movement days. Trading this through the accuracy of CFDs can be improved further, through the insights of a spreadsheet. Trading CFD for a living is about few such facts and setups, is not about evenly distributed opportunity on every trading day. But the problem of working with the variables, that of volatility and fine tuning CFD trade size and the timing, is all it boils down to.