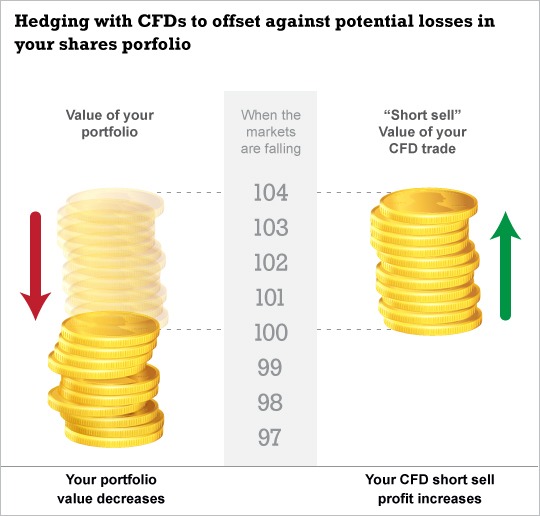

To trade forex online like a wise trader, one needs to focus on the right principles and the most comfortable strategy. The strategy doesn’t have to be the best, but feeling comfortable is much more important. CFD brokers for example facilitate extremely liquid and reliable forex trading, which no other kind of brokers can facilitate. This factor alone helps remove a huge factor of risk and stress. Moreover, CFDs allow for wise hedging possibilities and smarter ways to trade any classic forex strategy. By doing these simple steps, the trader can trade forex online and have a small but critical edge, from day one! There’s no single best forex trading strategy, many strategies can be good and profitable. And then there is the temptation of day trading forex live, which is the ultimate test for all brokers and traders. As provided liquidity itself is put to the test. Needless to mention that CFD brokers win this competition hands down, over their non CFD counterparts. Non CFD forex traders are faced with long delays in getting a proper filling price. Sometimes they get such bad fills on their trades that profitable trades close 50% below their potential maximum profit. That’s the way it is in the real world of day trading live, volatility takes no prisoners! And this makes it almost impossible to implement even proven strategies in a non CFD environment, because day trading is so much different than other strategies. Spot forex brokers are good for large size traders, trading slowly and at over $100 per pip. For any other case, and for less than $100 per pip, CFD brokers are the way to go. As they allow you to really capture every single pip of your intended trade, and turn it into real profit. So new traders need to be careful how they choose to trade the forex market, spot forex brokers cannot handle extreme market conditions. And these conditions are occurring every day when you day trade.

Trade Forex Online and Never Look back

Critics of forex trading argue that currencies are hard to predict, harder than stocks anyway. This is nonsense. Commodity currencies are actually easier to predict than many other markets. These alone invalidate their argument and can allow a trader to make millions. Moreover, anyone who makes blanket statements about either stocks, or forex, or any other market, probably doesn’t understand them in great depth. Traders can trade forex online and never look back, the forex market is highly versatile and full of different opportunities. There is opportunity because risk creates it. It’s a fact with irrefutable evidence and economics 101. Traders can see how other traders think, how veteran traders think and act, all through day trading forex live review reports. Where concepts, strategies and ideas are put to the test, and are evaluated objectively. Myths are busted and facts are further scrutinized.