Your CFD trading system can enhance the profitability of existing strategies. The superior performance of CFDs makes this possible through better filling price.

Your CFD Trading System is More than it Seems

Your CFD trading system enables you to trade in the most efficient way possible. So much so, that non-CFD retail traders are actually at disadvantage. Most online CFD brokers facilitate this kind of enhanced trading. And the benefits are often not presented well in CFD seminars. As many educators focus too much on leverage, ease of access to markets etc. But the real hidden benefits of CFDs, are enhanced liquidity and linear pricing. Both of these advantages are unique to CFDs, and not found in all other retail trading instruments. Futures and option traders for example suffer from non linear pricing. As these instruments don’t always follow the underlying market. And because markets are fast moving, linear instrument pricing can make all the difference between profit and loss. Wise CFD traders actually do use futures and options merely as indicators, exactly because of their non linear pricing. As this sometimes indicates how smart money is placed in the market. The actual market moves however are traded much better only through CFDs. And any experienced trader will confirm this.

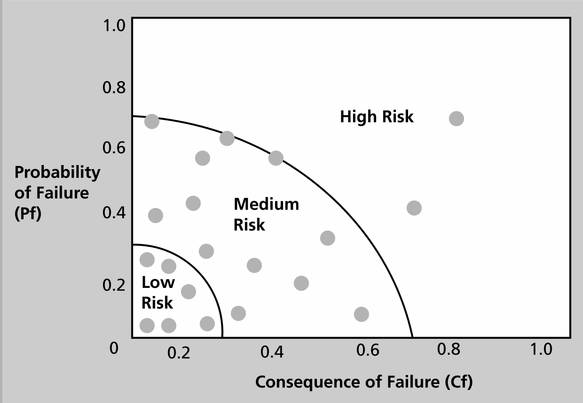

Your CFD Trading System Determines Your Profits

Your CFD trading system determines your profitability in various ways, which are not obvious. CFD trading systems for example, that apply risk control methods, do make more money. Since many losing trades are temporarily hedged. Thereby saving the trader the trouble of unnecessary stop running and impulsive trading actions. Most CFD trading platforms actually allow you to hedge CFD open trades, through the same market directly. Hedging is a temporary way to by-pass high risk times in the markets. The end result is much higher profitability in your trading strategy. Classic stop loss orders, especially those based on low risk-reward ratios, do not really work. Traders should avoid low risk-reward ratios altogether, because they are only a fantasy in the minds of some idealists. When these idealists get down from their ivory towers and trade in the real world, the truth appears. And the truth is that low risk-reward ratios have a very low probability of success. First they fail to secure sufficient exposure to volatile markets. And secondly, when a trade does go well, the profit should not be limited by the margin that such a ratio dictates. The ratio may indicate a desired 20 point profit, but the market may stand to offer 50 points. So low risk-reward ratios are total nonsense in real world trading.

You Can Do Better than Others

Your CFD trading system needs to take full advantage of the real hidden benefits of CFDs. And to apply the whole concept on any good trading strategy. Even a marginally profitable strategy may be improved beyond recognition, through wise CFD trading. Classic stock investors are also turning to CFDs, as a way to hedge downside risk cost effectively. But even this long term investing can be improved more. All it takes is a good analytical mind to quantify risk against time. In this case, the idea is to always keep the actual shares of the underlying stock. And then trade in both directions as stock price fluctuates through different levels and chart patterns.