A trader’s learning curve is cut shorter when they learn forex basics in-depth. This enables them to be an active rather than a passive trader, thinking right.

Learn Forex Basics beyond the Obvious

Traders who learn forex basics have a better chance of evaluating their own trading systems right. As opposed to traders who fail to understand them. All basic concepts, such as market terms, pip value calculation, leverage and volatility, are all important basics. All forex strategies will require you at some point to reevaluate them, and possibly make improvements. Basic training also includes definitions of swing trading theory, and picking entry points. Even though the task of picking entry points in the market is enormously huge and diverse. Traders can learn the basic ideas which define the average market trend. All these things will not make you a trader. But will act so as to improve your judgment on the market. Carry forex trading requires all these basics, and a good understanding of the definitions, at all times. As profitability in Carry forex trading is often hidden away. And only after few calculations can traders figure out whether there is a profit margin or not.

Learn Forex Basics for Hedging Strategies

Carry forex trading is a hedging strategy itself. But there are many more concepts where hedging is used in one way or another. Accuracy of calculations is extremely important. And knowing the basic definitions helps avoid miscalculation of market risk. When you learn forex basics, you should not think like everyone else. Rather, you learn in order to be better than the average trader, in real trading. And not for the purpose of impressing your friends with your knowledge of forex. They all want to learn how to trade forex but most are lazy, and only after the easy way. Lazy learners cannot make it far in the financial markets, because they focus too much on entry points. While ignoring money management and basic risk calculation. Which means they will find it increasingly difficult to assess risk in more complicated scenarios.

Go Further than Others

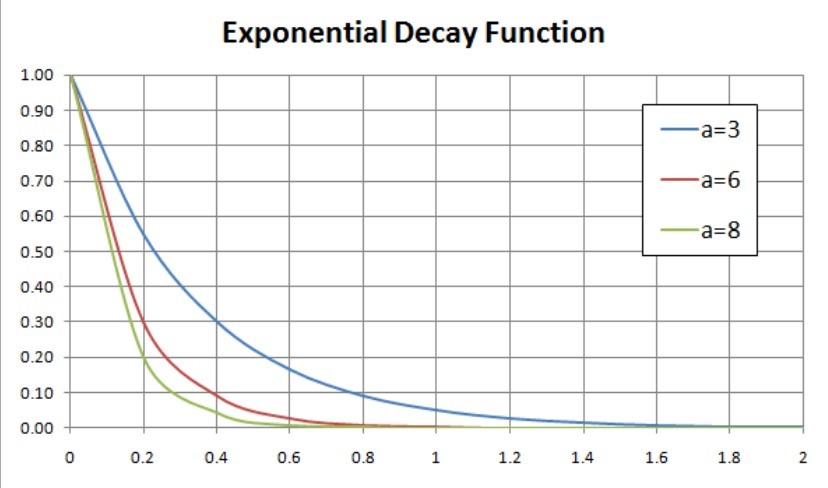

You can become a better, much better trader by also understanding the basics of probability. This will make you see why trading on the news is a bad idea. And also which kinds of trades offer the highest probability of success. Probability theory is fascinating, and it will help sharpen your risk assessment skills, in amazing ways. You can learn forex basics and apply basic probability theory on everything you do in the markets. Probability theory can allow you to go further, by studying the patterns of the losing trades. And to be able to detect them early, before they actually become losing trades. This alone is worth studying probability theory for. As it is more important not to lose in the markets, than to win. And once the losing trades are kept in control, the profitable ones will take care of themselves. Because by simply removing more and more risk from the equation, all that will remain is the reward. So to learn forex basics could really transform you into a new innovative trader. You can even do better than people who are probability specialists, who simply don’t make use of their knowledge.