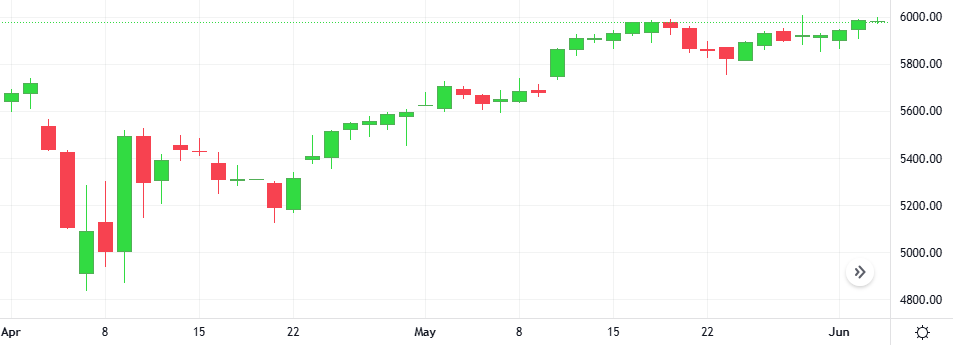

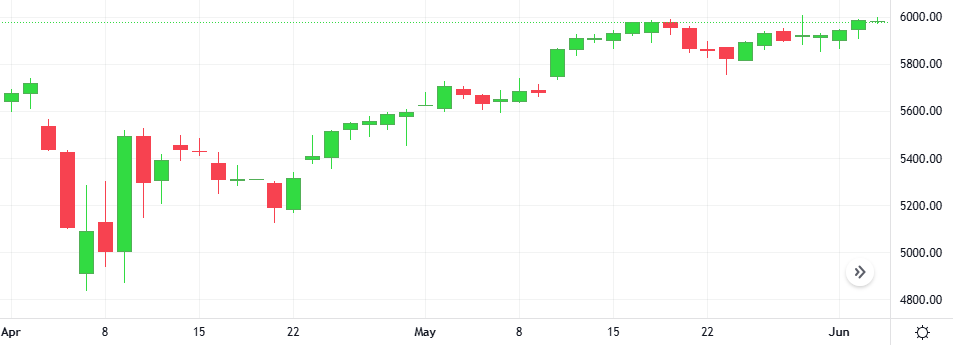

The benchmark S&P 500 stock index ended modestly higher, supported by technology shares, but some early gains evaporated as weak data revealed the economic toll taken by President Donald Trump’s erratic trade policies.

The benchmark S&P 500 stock index ended modestly higher, supported by technology shares, but some early gains evaporated as weak data revealed the economic toll taken by President Donald Trump’s erratic trade policies.

U.S. stocks advanced and the dollar rebounded as investors weighed progress in ongoing U.S. tariff talks and lowered economic expectations ahead of Friday’s crucial U.S. employment report. All three major U.S. stock indexes ended the session with gains.

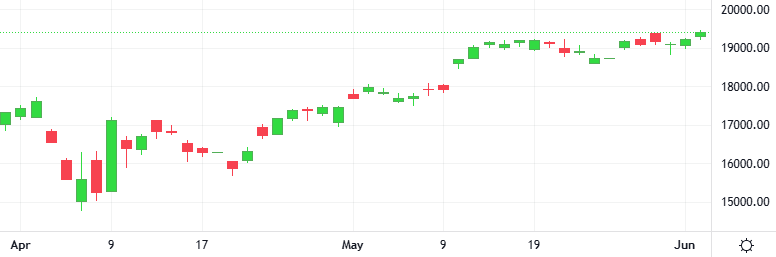

Oil prices climbed to a two-week high as persistent geopolitical tensions between Russia and Ukraine, and the U.S. and Iran looked set to keep sanctions on both OPEC+ members Russia and Iran in place for longer.

The Oil-Dollar pair gained 0.5% in the last session. The MACD is giving a positive signal.

Support: 60.599 | Resistance: 64.86

Gold fell nearly 1% after hitting a near four-week high, pressured by a firmer dollar as investors grew cautious ahead of a potential call between U.S. President Donald Trump and Chinese leader Xi Jinping.

The Gold-Dollar pair dropped 0.9% in the last session after rising as much as 1.0% during the session. The MACD is giving a positive signal.

Support: 3272.9 | Resistance: 3439

The U.S. dollar fell across the board, giving up the previous week’s gains, as markets weighed the outlook for President Donald Trump’s tariff policy and its potential to hurt growth and stoke inflation.

The Oil-Dollar pair rose 1.4% following a 1.6% intra-session dip. The Stochastic indicator is giving a positive signal.

Support: 59.722 | Resistance: 65.332

Gold rose to its highest in over three weeks, as a weakening dollar and a combination of geopolitical risks and economic uncertainty fuelled investor demand for safe-haven assets. U.S. gold futures settled 2.5% higher.