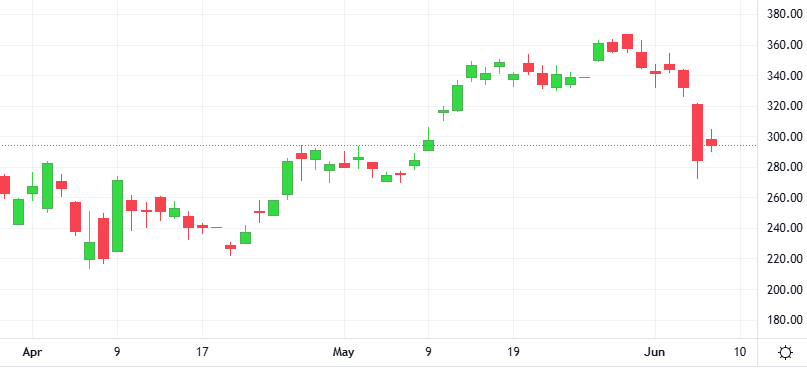

Cracks in the relationship between President Donald Trump and Tesla CEO Elon Musk, his self-proclaimed “First Buddy”, are scaring Tesla shareholders as the two fired salvos at each other in increasingly heated rhetoric, sending shares down

Cracks in the relationship between President Donald Trump and Tesla CEO Elon Musk, his self-proclaimed “First Buddy”, are scaring Tesla shareholders as the two fired salvos at each other in increasingly heated rhetoric, sending shares down

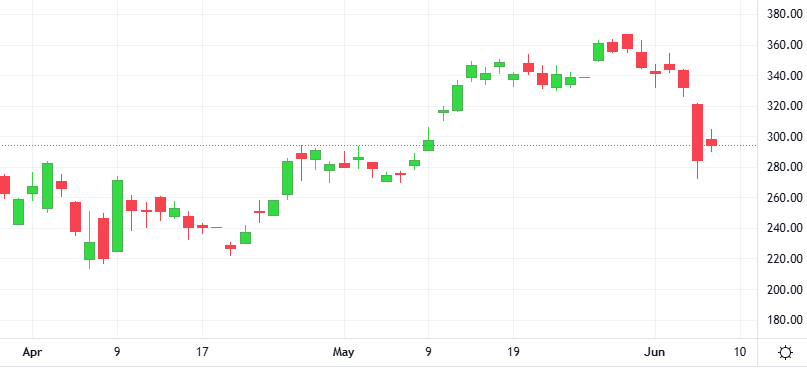

Gold rose 1%, supported by a softer dollar and weak U.S. data, as investors grappled with mounting economic and political uncertainty. The U.S. dollar index fell 0.5%, making gold cheaper for buyers holding other currencies.

The Gold-Dollar pair gained 0.4% in the last session. The ROC’s is giving a negative signal.

Support: 3307.9 | Resistance: 3430.2

The dollar fell across the board after weaker-than-expected U.S. private payrolls numbers highlighted continued easing in the labor market and data showed the U.S. services sector contracted. Trump reiterated his calls for Federal Reserve Chair Jerome Powell to lower interest rates following the data.

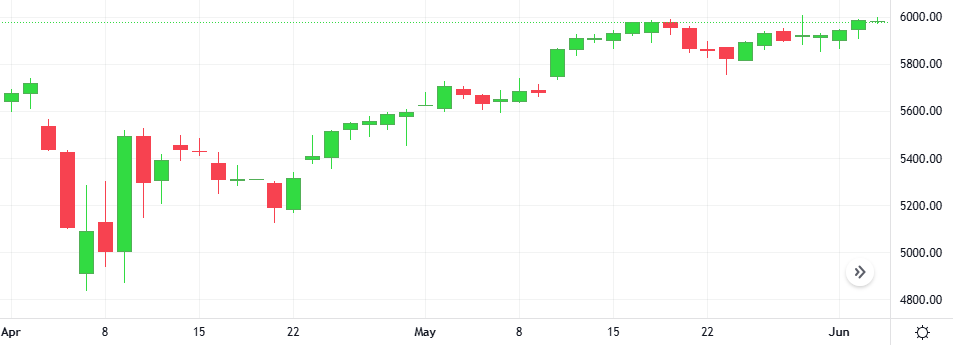

The benchmark S&P 500 stock index ended modestly higher, supported by technology shares, but some early gains evaporated as weak data revealed the economic toll taken by President Donald Trump’s erratic trade policies.

U.S. stocks advanced and the dollar rebounded as investors weighed progress in ongoing U.S. tariff talks and lowered economic expectations ahead of Friday’s crucial U.S. employment report. All three major U.S. stock indexes ended the session with gains.

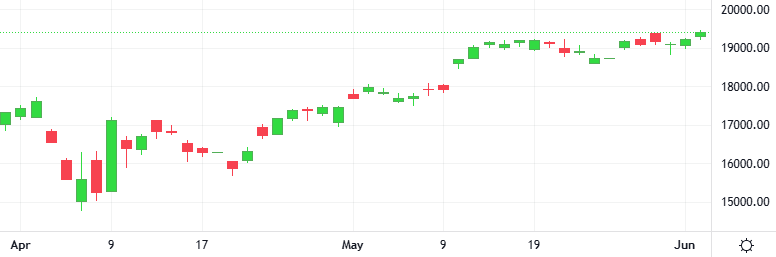

Oil prices climbed to a two-week high as persistent geopolitical tensions between Russia and Ukraine, and the U.S. and Iran looked set to keep sanctions on both OPEC+ members Russia and Iran in place for longer.

The Oil-Dollar pair gained 0.5% in the last session. The MACD is giving a positive signal.

Support: 60.599 | Resistance: 64.86