Traders wonder if they can trade currencies successfully, using a single forex trading indicator. Combining different indicators is more tricky than it seems.

The Truth about Using a Single Forex Trading Indicator

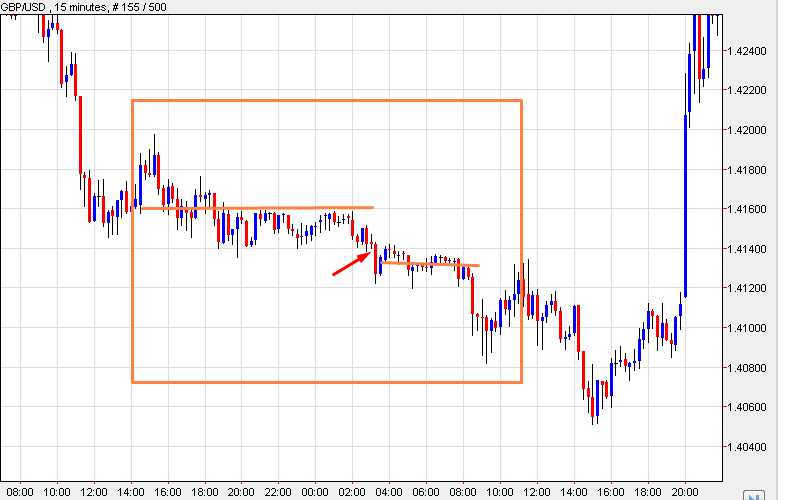

Using a single forex trading indicator alone, is often thought as a way to simplify trading. Day traders especially do believe in this concept, since they have to deal with fast changing, live forex rates and forex news stories. These day traders however come prepared into the market, having done a lot of homework based on the daily chart and yesterday’s close. And they do use more than one indicators for that. In day trading, they can resort to a single indicator, it is possible to some extend, though it is not the best way to trade. Using a single forex trading indicator alone, does bring in simplicity and agility. But that indicator would have to be price based. If price is used as an indicator, on its own, some predictability is possible on the market. But when the market is due to give a false signal, or some other confusing pattern, all price based indicators ultimately fail. There goes the old saying that the market is always right. But in fact, it isn’t always right! The market can be wrong, and so using price or price momentum alone, as indicators for trading can be a very big mistake. Price may move in the misleading direction just because of profit taking. Making the market seem moving in that direction, but profit taking is not a real trend. Real trends are based on objectives and targets that carry a lot of weight. That’s where the market want to go, and if it doesn’t go there today or tomorrow, it will still go there before the week is out. So be careful of price and momentum indicators, because they can be way too misleading.

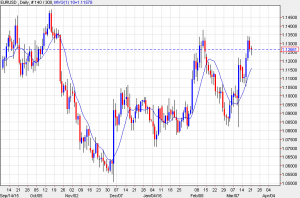

The 10 Day Moving Average as a Single Forex Trading Indicator

The 10 day moving average is an example of a forex trading indicator which can be used more or less, on its own. It is an average (which means price and momentum and misinformation) but it is based on the daily close. The daily close of most markets carries more weight than the high and the low. Because there is more meaningful trading volume during the last trading hour of the daily session. The 10 day moving average does not yield clear forex signals, but it does hint near term direction and momentum. Especially when a new trend has just started, traders can confirm early in the trend the validity of the move. All they have to do is check contrarian indicators, for just one time. And if the move is confirmed. Then they are good to go and trade on the 10 day moving average alone, for several days at least. The idea is to buy the market if price is above this average, it’s that simple. Using too many indicators, and using them all at the same time is too confusing and not recommended. Wise traders use 5 to 7 good indicators, in different ways. And they also expect that all of these indicators will have failures at one point or another. Using a single indicator alone is not a good idea, but if it has to be done, then the 10 day moving average can be used for several days in a row. But only on newly started trends, confirmed once, by some other indicator, such as contrarian indicators confirming reversals.