Gold prices eased as investors booked profits after prices hit a near two-week high in the previous session, while the market’s focus shifted to U.S. President Donald Trump’s upcoming Federal Reserve nominations.

Gold prices eased as investors booked profits after prices hit a near two-week high in the previous session, while the market’s focus shifted to U.S. President Donald Trump’s upcoming Federal Reserve nominations.

United States spot Ether ETFs recorded almost half a billion dollars in daily net outflows, marking their highest in a single day since launch. This was their second day of outflows since breaking a 20-day inflow streak on Friday.

Wall Street’s main indexes swung to losses after data showed U.S. services activity unexpectedly stalled and investors considered the impact of U.S. trade policies on corporate profits.

Oil prices edged lower as rising OPEC+ supply and worries of weaker global demand countered concern about U.S. President Donald Trump’s threats to India over its Russian oil purchases.

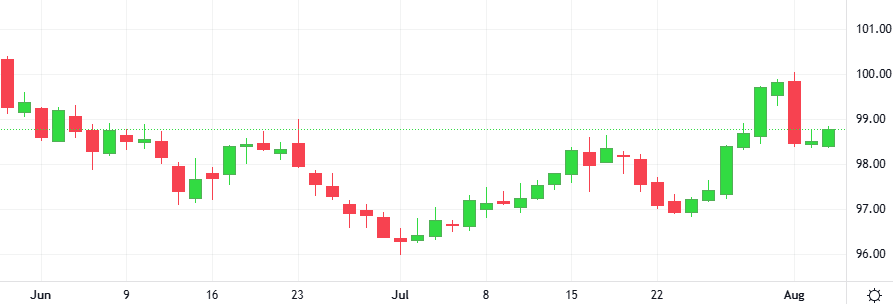

The U.S. dollar slightly recovered, consolidating recent moves, after Friday’s trio of market-moving events that showcased the fragility of the greenback: a dismal U.S. jobs report, the resignation of a Federal Reserve Governor, and President Donald Trump’s firing of a top statistics official.

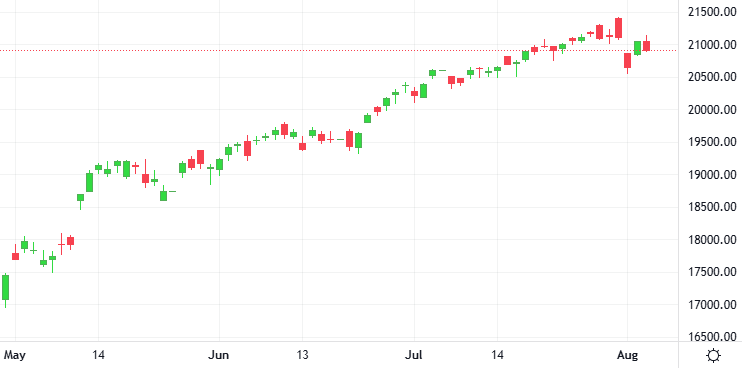

Gold prices rose for a third straight session after last week’s economic data fueled expectations of interest rate cuts by the U.S. Federal Reserve. Spot gold rose to it’s highest since July 24th.