Oil prices edged lower as rising OPEC+ supply and worries of weaker global demand countered concern about U.S. President Donald Trump’s threats to India over its Russian oil purchases.

Oil prices edged lower as rising OPEC+ supply and worries of weaker global demand countered concern about U.S. President Donald Trump’s threats to India over its Russian oil purchases.

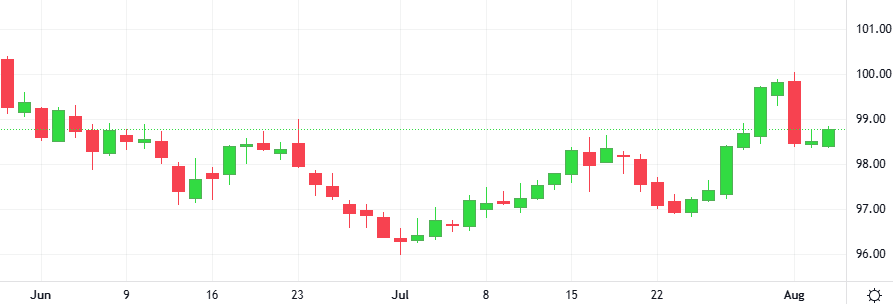

The U.S. dollar slightly recovered, consolidating recent moves, after Friday’s trio of market-moving events that showcased the fragility of the greenback: a dismal U.S. jobs report, the resignation of a Federal Reserve Governor, and President Donald Trump’s firing of a top statistics official.

Gold prices rose for a third straight session after last week’s economic data fueled expectations of interest rate cuts by the U.S. Federal Reserve. Spot gold rose to it’s highest since July 24th.

Cryptocurrency investment products ended last week in the red, interrupting 15 weeks of consecutive inflows after investor sentiment took a hit from hawkish remarks during last week’s Federal Open Market Committee meeting.

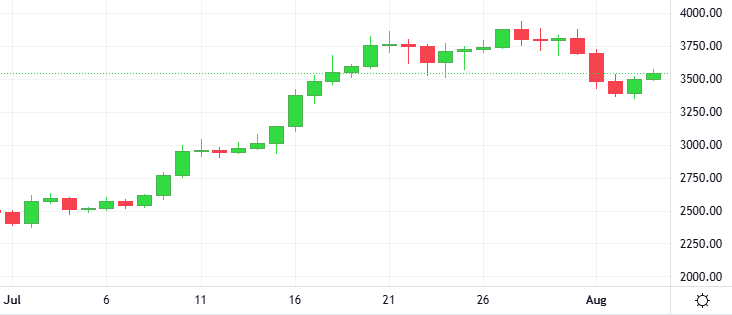

SharpLink has continued its aggressive accumulation of Ether, adding another 15,822 ETH, worth approximately $53.9 million. The purchases were split across multiple transactions, with the largest single transfer totaling 6,914 Ether, valued at $23.56 million.

OPEC+ agreed in principle to boost oil output by 548,000 barrels per day in September, as the group finishes unwinding its biggest tranche of production cuts amid fears of further supply disruptions from Russia.