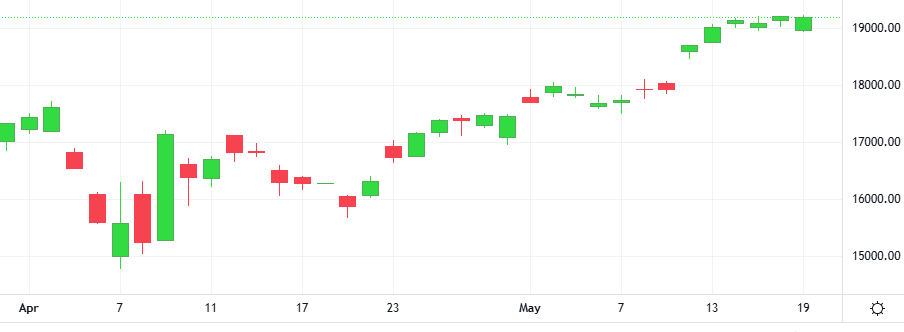

Gold prices drifted higher, steered by a softer dollar and safe-haven demand after Moody’s downgraded the U.S. government’s credit rating. U.S. gold futures settled 1.5% higher.

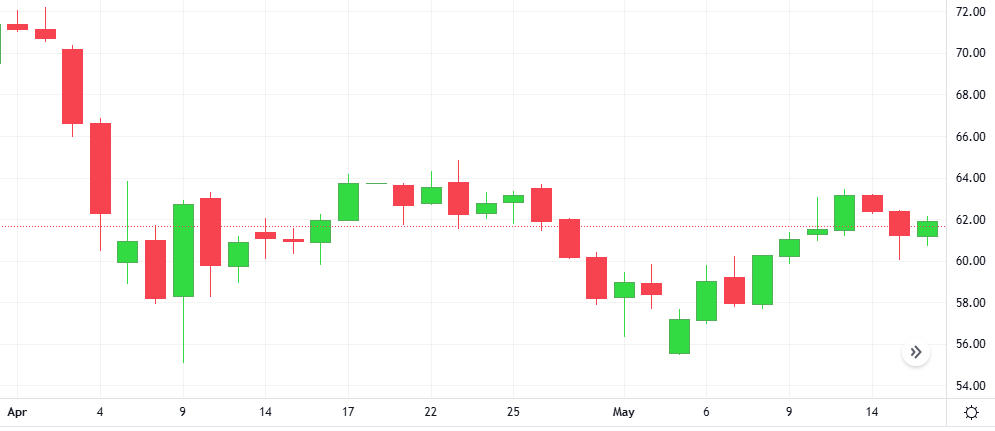

The Gold-Dollar price remained largely unchanged in the last session. The Stochastic indicator is giving a positive signal.

Support: 3166.7 | Resistance: 3296