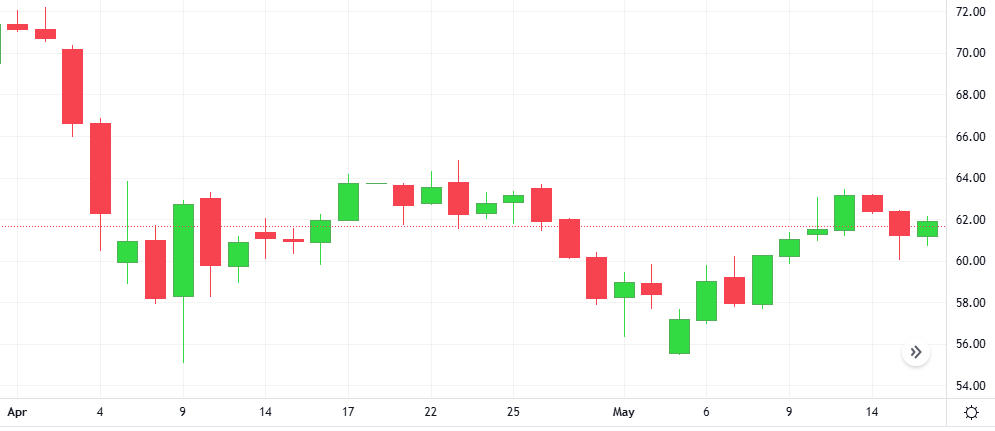

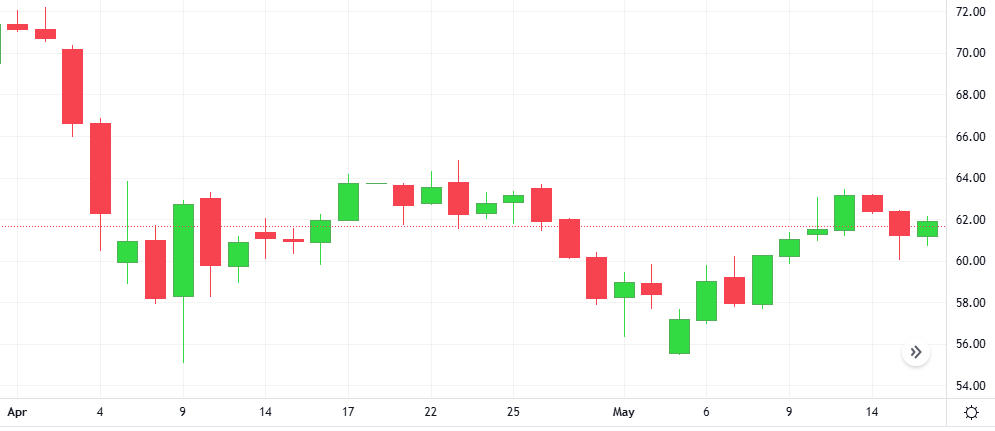

Oil settled higher on Friday, notching a second straight week of gains on easing U.S.-China trade tensions, although prices were held back by expectations of higher supply from Iran and OPEC+.

Oil settled higher on Friday, notching a second straight week of gains on easing U.S.-China trade tensions, although prices were held back by expectations of higher supply from Iran and OPEC+.

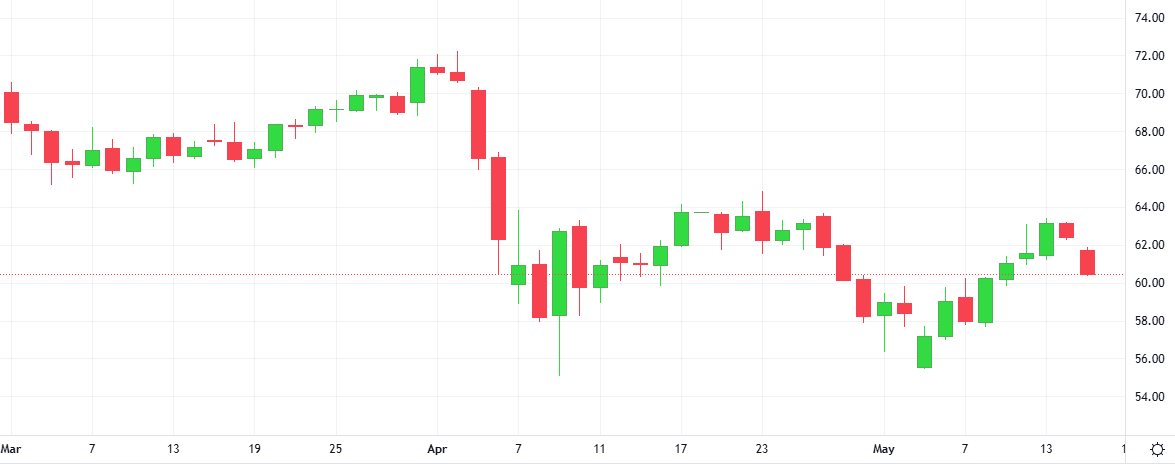

Gold prices have fallen almost 10% from a record high just above $3,500 per ounce in April as a de-escalation in U.S.-China trade tensions punctured momentum, but analysts are sticking with a bullish outlook due to strong underlying support for the metal.

The Gold-Dollar pair plummeted 1.1% in the last session. The RSI is giving a positive signal.

Support: 3055.9 | Resistance: 3349.5

Tesla blocked shareholders who own less than 3% of its shares from suing its directors or officers on behalf of the electric vehicle maker for breach of duties, according to a filing with the SEC. 3% of Tesla’s shares amounts to $34 billion as of Friday’s close.

Oil prices eased after government data showed U.S. crude oil stockpiles rose unexpectedly last week, prompting investor concerns of excess supplies. Both benchmarks traded close to their highest in two weeks in the previous session, lifted by a temporary cut in U.S.-China tariffs.

The S&P 500 closed slightly higher after flitting between gains and losses during the session as investors waited for the next batch of economic data after a robust start to the week spurred by soft inflation data and a U.S.-China tariff truce.

Gold prices dropped more than 2%, hitting an over one-month low, as rising trade optimism boosted risk appetite, leading investors to shift away from bullion. U.S. gold futures settled 1.8% lower.