The dollar hit a one-month high versus the euro in the wake of a string of trade agreements between the United States and its major trade partners, while markets await interest rate decisions from the Federal Reserve and the Bank of Japan.

The dollar hit a one-month high versus the euro in the wake of a string of trade agreements between the United States and its major trade partners, while markets await interest rate decisions from the Federal Reserve and the Bank of Japan.

Oil prices rose after a trade deal between the U.S. and the European Union, and U.S. President Donald Trump’s announcement that he would shorten the deadline for Russia to end its war in Ukraine or face sanctions.

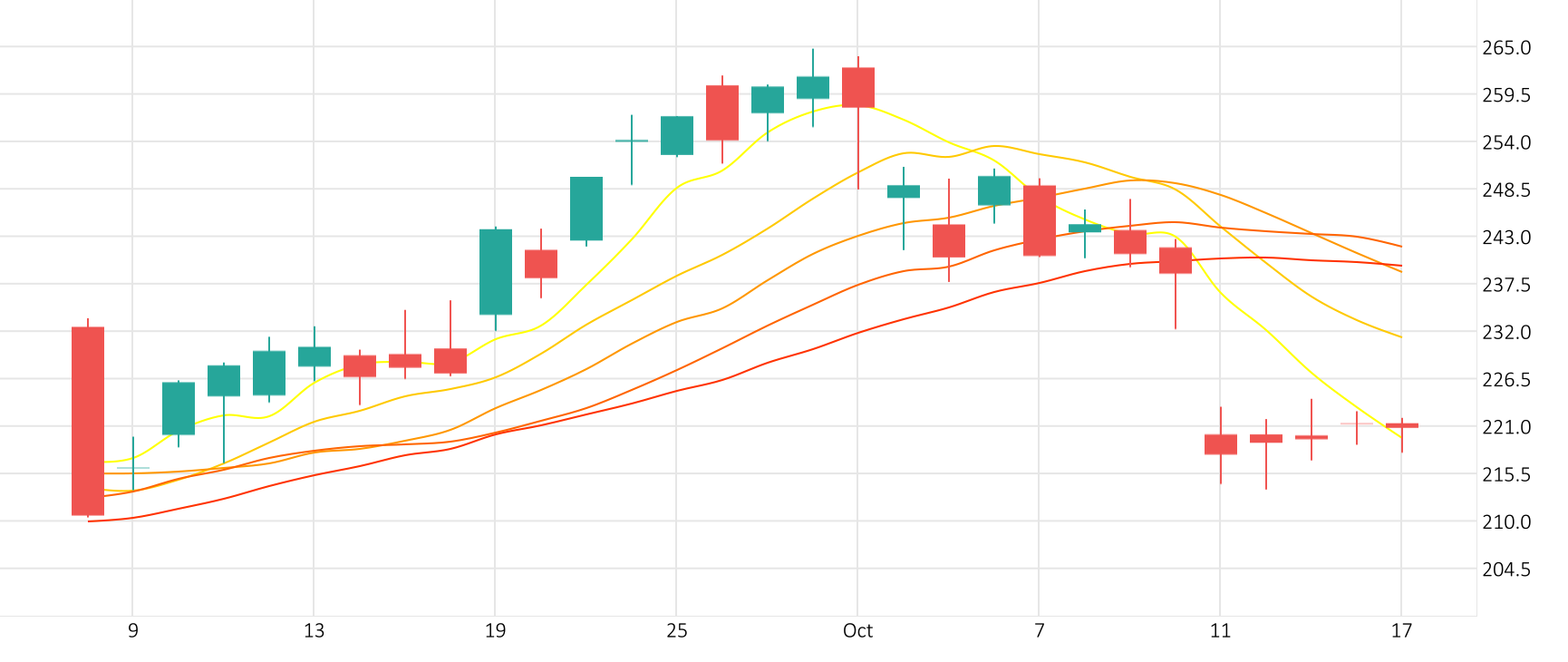

The dollar gained against major currencies including the euro and yen with sentiment lifted by a trade agreement between the U.S. and the EU, which brings market certainty and averts a global trade war.

Tesla has signed a $16.5 billion deal to source chips from Samsung Electronics, a move that could bolster the South Korean tech giant’s unprofitable contract business but is unlikely to help Tesla sell more EVs or roll out robotaxis more quickly.

The U.S. dollar advanced on Friday, bolstered by solid economic data that suggested the Federal Reserve could take its time in resuming interest rate cuts, while tariff negotiations showed more clarity that eased some uncertainty in the market.

Corporate adoption of Bitcoin is accelerating, with 35 publicly traded companies now holding at least 1,000 BTC each. Demand for Bitcoin is soaring among public companies four months after US President Donald Trump’s executive order outlined the creation of a federal Bitcoin reserve.