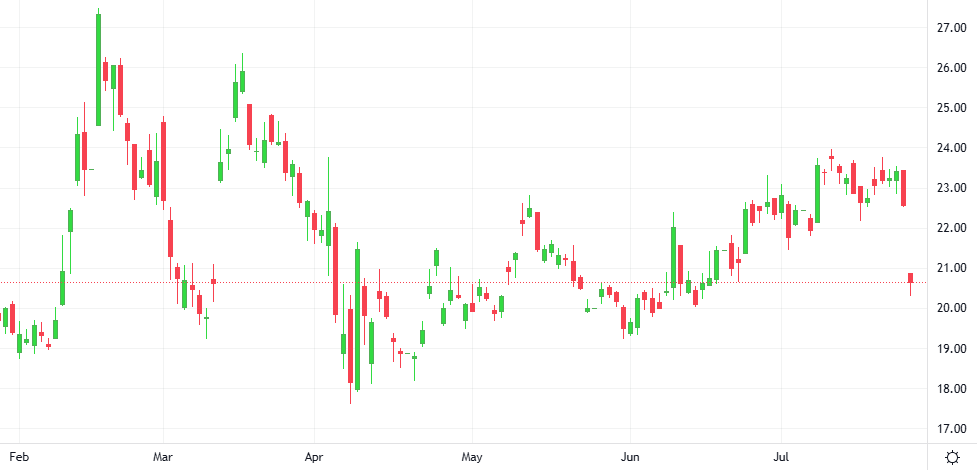

A looming U.S. deadline for more severe global tariffs is among a barrage of upcoming events threatening to disrupt an increasingly calm U.S. stock market. Trump has extended a deadline to August 1 for when higher levies will take effect on an array of trading partners unless deals are struck.