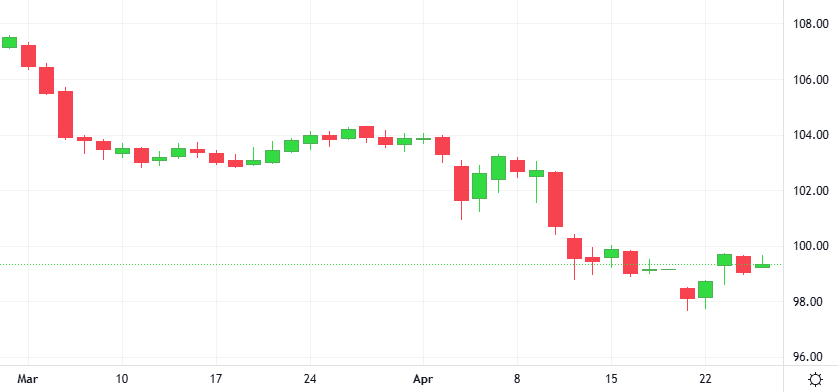

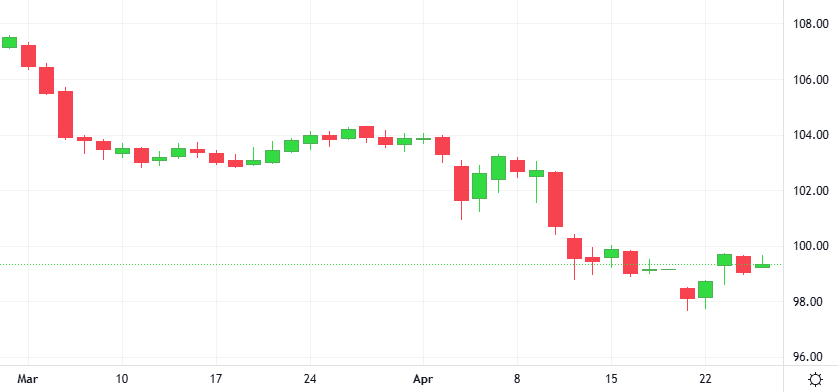

The dollar staged a broad retreat, as investor gloom over the lack of progress toward defusing the U.S.-China trade war reasserted itself following an interlude of optimism the previous day.

The dollar staged a broad retreat, as investor gloom over the lack of progress toward defusing the U.S.-China trade war reasserted itself following an interlude of optimism the previous day.

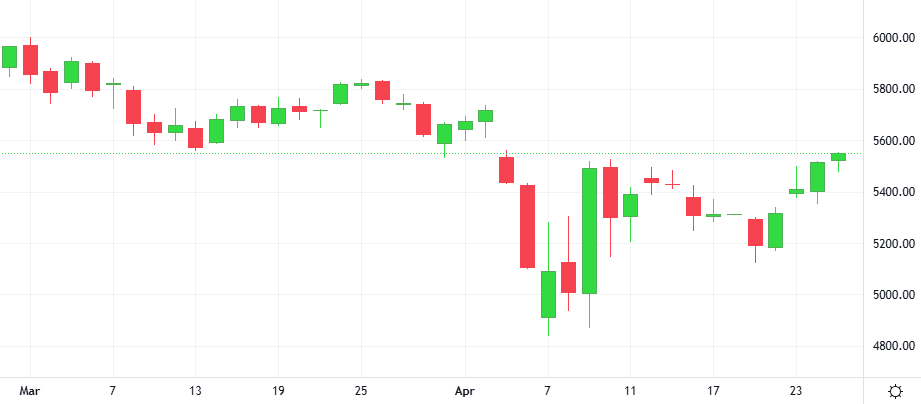

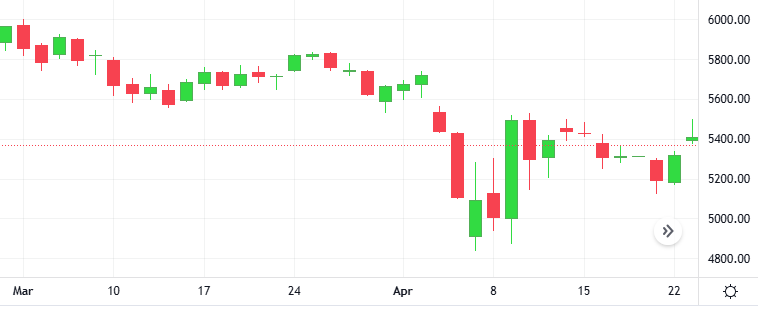

Wall Street extended its rally with a solid boost from technology shares as investors parsed a mixed bag of corporate earnings and watched for signs of progress in the U.S.-China tariff stand-off. All three major U.S. stock indexes were higher.

Binance has introduced ‘Fund Accounts,’ a feature enabling portfolio managers to consolidate client assets into omnibus accounts. This move aims to simplify operations and enhance trading efficiency, marking a significant step in bridging traditional finance with crypto

Wall Street stocks surged on revived hopes for progress in the U.S.-China trade dispute and President Donald Trump’s assurances that he has “no intention of firing” Federal Reserve Chair Jerome Powell, soothing fears that the central bank could lose its autonomy.

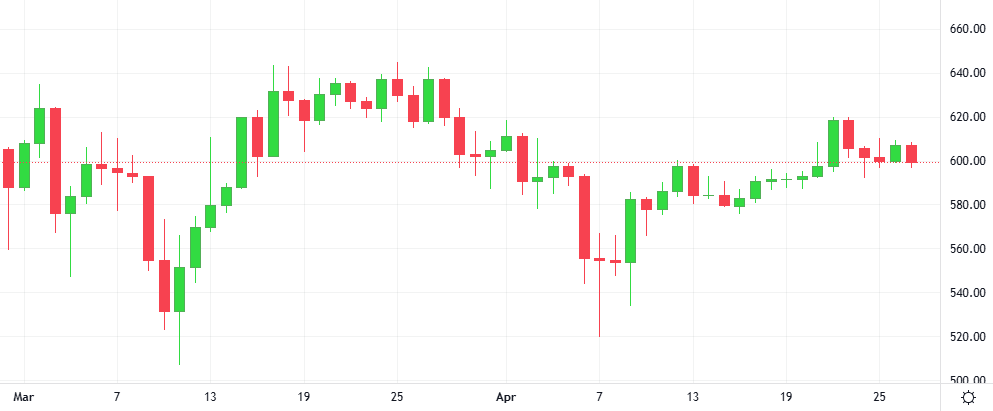

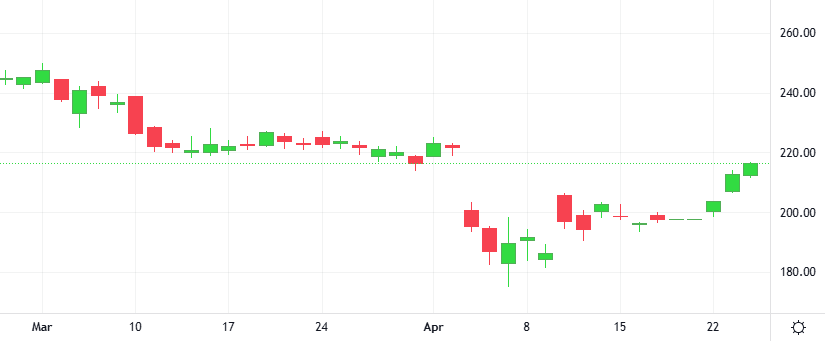

Gold extended its retreat from an all-time high, as appetite for riskier assets improved after President Donald Trump said he has no plans to fire the U.S. Fed’s chief and also signalled progress with China on the tariff front.

The Gold-Dollar pair plummeted 1.3% in the last session. The RSI is giving a positive signal.

Support: 3115 | Resistance: 3493.3

German sportswear and apparel maker Adidas reported first-quarter sales and profit above expectations, citing growth across all its markets and channels. First-quarter operating profit jumped 82% to 610 million euros, the group said, resulting in a margin of 9.9%.