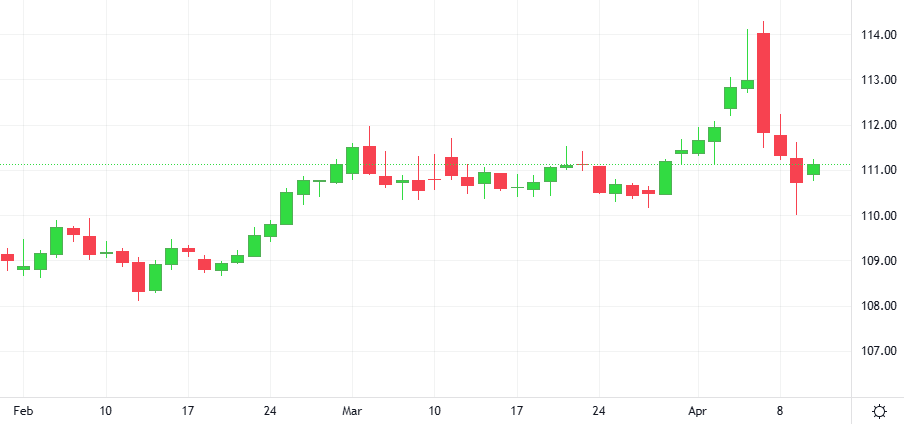

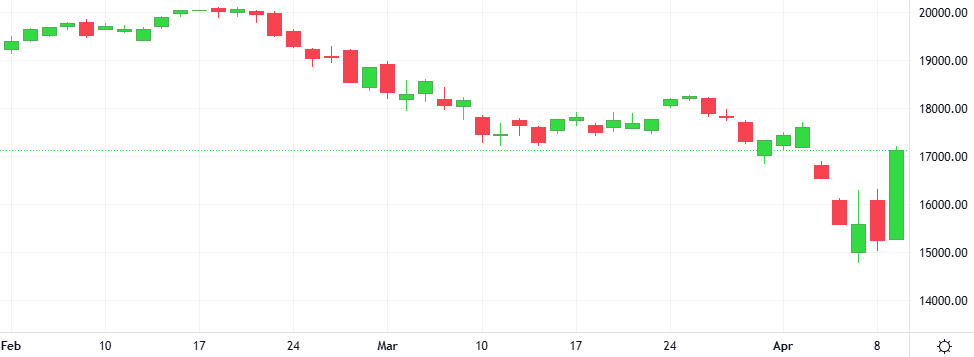

Wild swings in global markets are poised to keep U.S. stock investors on edge in the coming week, as a weakening dollar and a selloff in Treasuries compound extreme equity volatility that erupted after President Donald Trump launched his sweeping tariffs.

U.S. President Donald Trump’s administration granted exclusions from steep reciprocal tariffs to smartphones, computers and some other electronics imported largely from China, providing a big break to tech firms like Apple that rely on imported products.