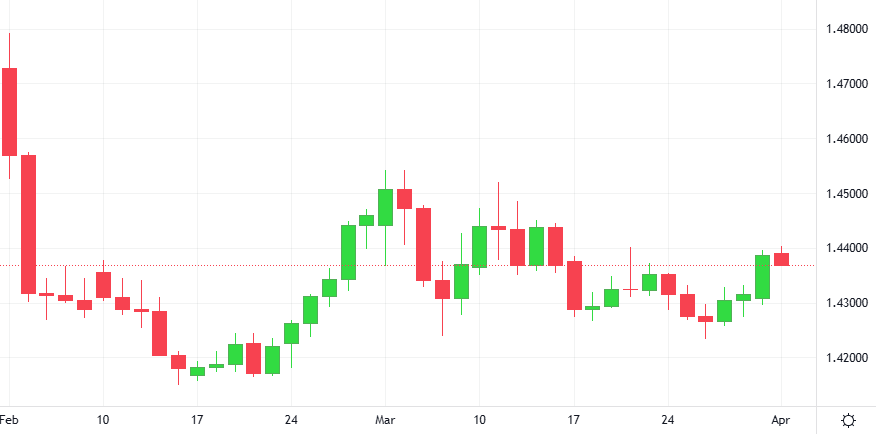

The yen rose and the dollar index fell as investors digested the latest round of U.S. economic data ahead of tariff announcements from the Trump administration due today. U.S. manufacturing contracted in March after two consecutive months of expansion.

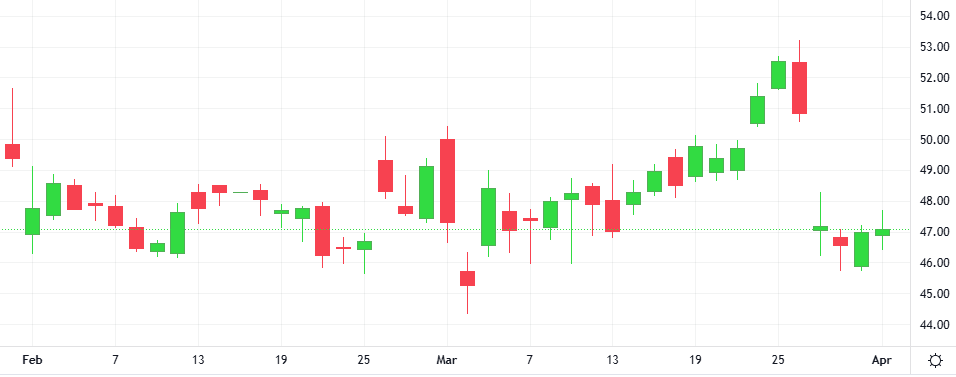

The Dollar-Yen pair fell 0.3% in the last session. The MACD is giving a positive signal.

Support: 148.95 | Resistance: 150.29