Wall Street stocks advanced while crude and gold prices slid as investors juggled corporate earnings, signs of progress in U.S. President Donald Trump’s tariff negotiations, and increased odds of a global recession.

Wall Street stocks advanced while crude and gold prices slid as investors juggled corporate earnings, signs of progress in U.S. President Donald Trump’s tariff negotiations, and increased odds of a global recession.

Gold fell nearly 1% as signals of easing U.S.-China trade tensions reduced some safe-haven demand, while investors braced for key economic data this week to gauge the Federal Reserve’s policy outlook.

U.S. President Donald Trump will soften the blow of his auto tariffs through an executive order mixing credits with relief from other levies on parts and materials, after automakers pressed their case with the administration.

IBM will invest $150 billion in the U.S., including on facilities for quantum computer production, over the next five years, the latest American technology company to back the Trump administration’s push for local manufacturing.

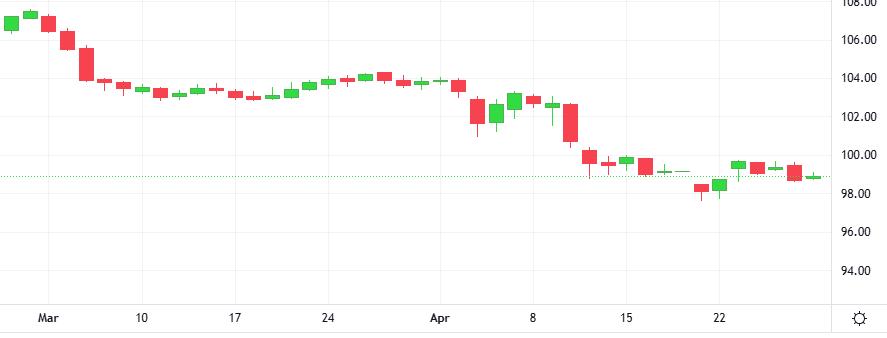

The U.S. dollar slid across the board, as investors waited warily for further news of U.S. trade policy and braced for a week packed with economic data, which may initially provide an indication on whether U.S. President Donald Trump’s trade war is hitting home.

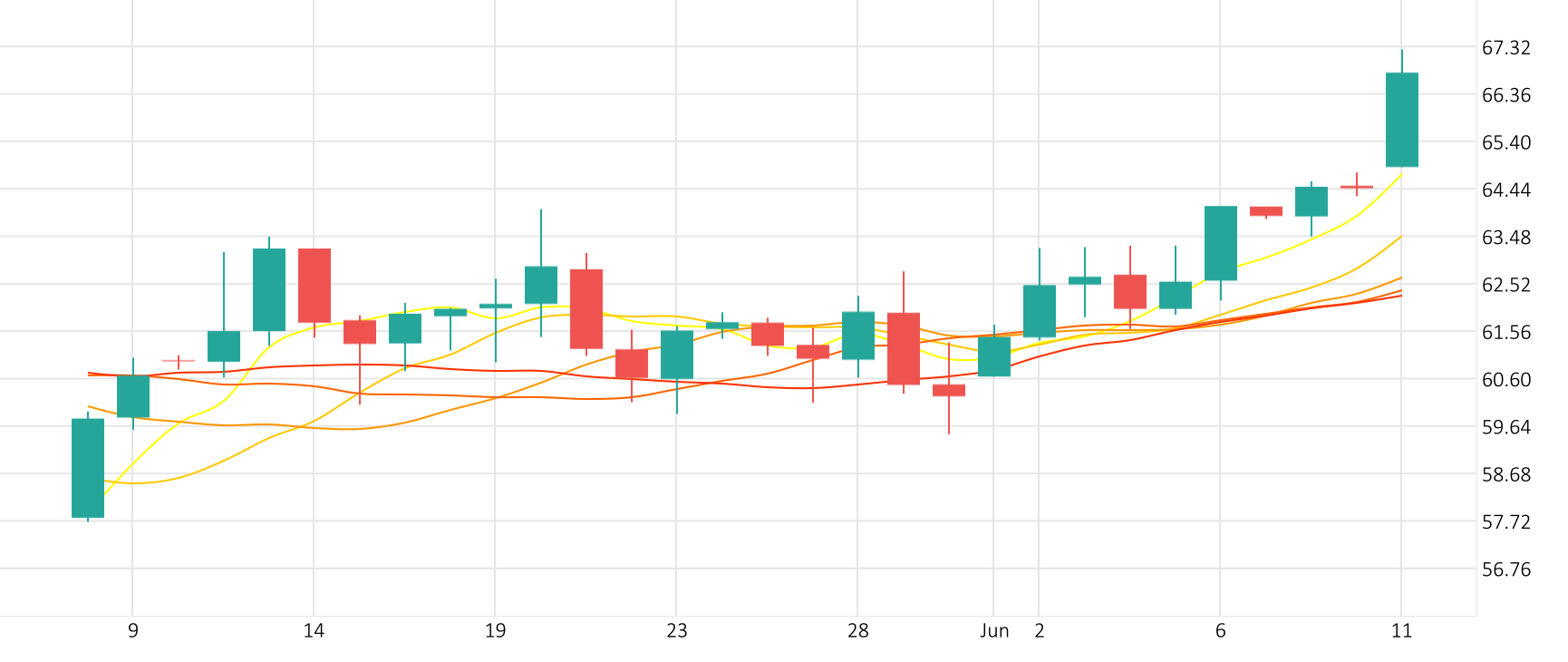

Brent crude oil prices fell as economic worries from the U.S.-China trade war were pressuring demand. The U.S.-China trade war is dominating investor sentiment in moving oil prices, superseding nuclear talks between the U.S. and Iran and discord within the OPEC+ coalition.

The Oil-Dollar pair plummeted 2.0% in the last session. The Stochastic-RSI is giving a positive signal.

Support: 58.859 | Resistance: 64.89