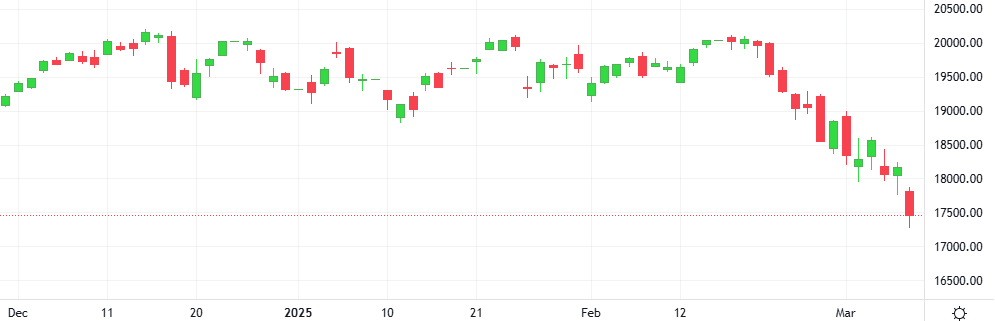

The British benchmark index fell to a near five-week low, tracking a global equity selloff as worries about economic growth and uncertainties around U.S. tariffs continued to keep investors on edge.

The British benchmark index fell to a near five-week low, tracking a global equity selloff as worries about economic growth and uncertainties around U.S. tariffs continued to keep investors on edge.

U.S. stocks plunged as relentless tariff wrangling and mounting anxieties arising from the chaos in Washington gave rise to fears that the U.S. economy could be careening into recession. The tech-loaded Nasdaq suffered the most, tanking 4.2%

A critical inflation report in the coming week could further rattle an increasingly tumultuous U.S. stock market, with investors worried about an economic growth slowdown and President Donald Trump’s tariffs. Despite a gain on Friday, the benchmark S&P 500 marked its worst week in six months.

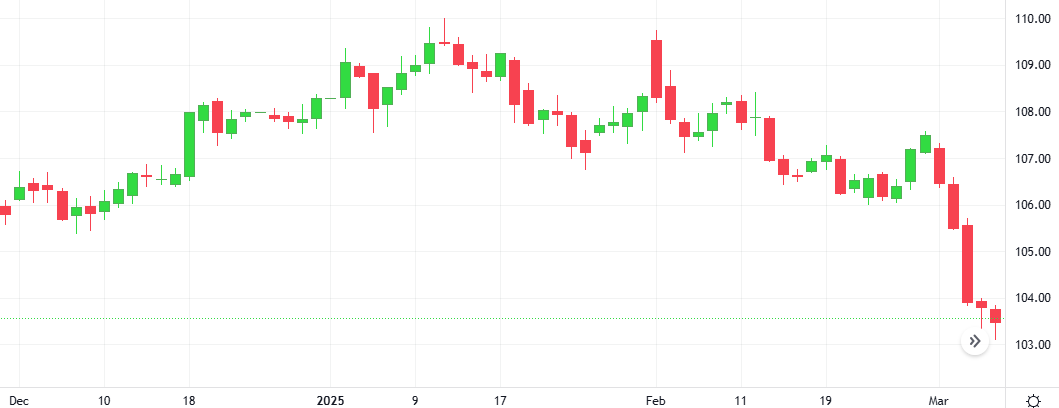

The U.S. dollar dropped to multi-month lows against the euro and yen and fell versus most currencies to end last week after data showed the labor market in the world’s largest economy slowed last month, creating fewer jobs than expected.

The Gold-Dollar pair traded sideways in the last session. The Stochastic-RSI is giving a positive signal.

Support: 2860.8 | Resistance: 2962.3

The U.S. dollar dropped to multi-month lows against the euro and yen and fell versus most currencies to end last week after data showed the labor market in the world’s largest economy slowed last month, creating fewer jobs than expected.

The euro hit four month highs against the U.S. dollar, as Europe’s growth prospects improved after Germany’s proposed 500-billion euro infrastructure fund, potentially offsetting global trade tensions. The single currency is up nearly 3.7% this week, already on track for its best week since November 2022.

The Euro-Dollar pair exploded 1.4% in the last session. The Ultimate Oscillator is giving a positive signal.

Support: 1.0466 | Resistance: 1.1027