Global benchmark Brent was down nearly 3%, recovering slightly from a three-year low hit earlier in the session, after U.S. crude oil stockpiles posted a larger-than-expected build, adding a further headwind as investors worried about OPEC+ plans to increase output in April and U.S. tariffs on Canada, China and Mexico.

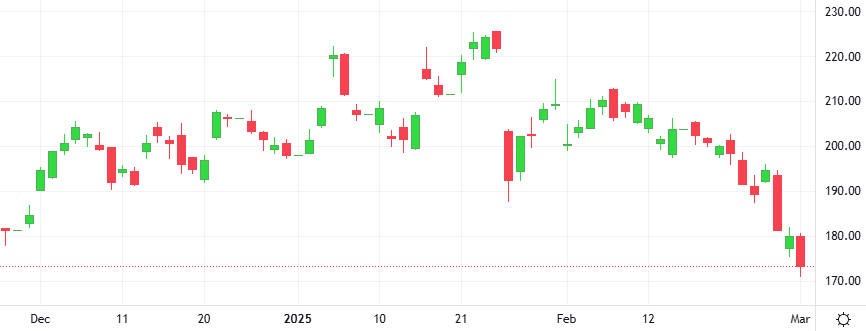

After a 4.0% dip during the last session, the Oil-Dollar pair closed with a 2.5% drop. The ROC is giving a negative signal.

Support: 61.942 | Resistance: 70.402