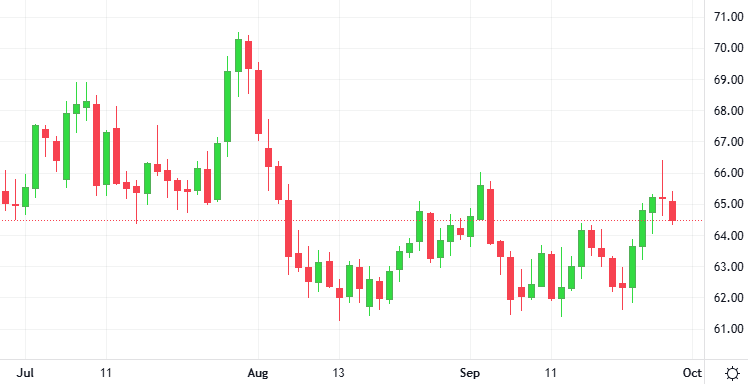

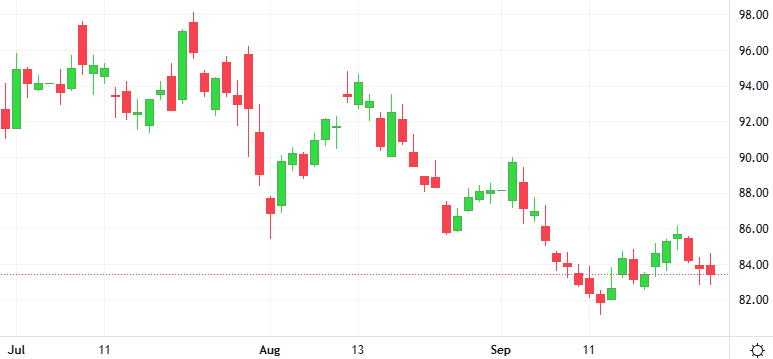

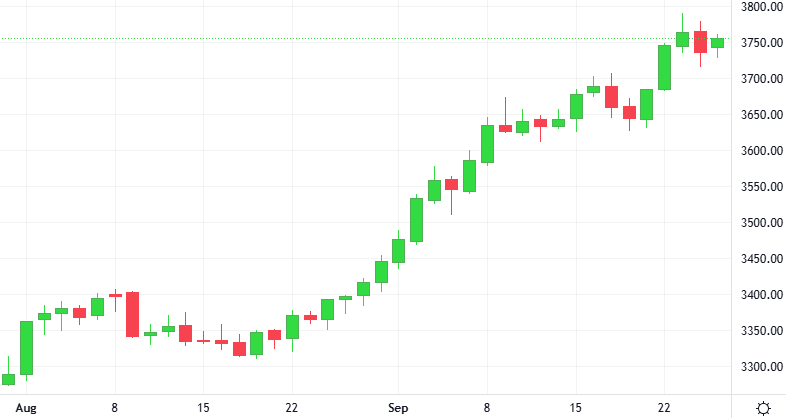

US-based spot Ether exchange-traded funds have posted five straight net outflow days as the asset’s price slid around 10% over the week. On Friday, spot Ether ETFs closed the trading week with $248.4 million in daily outflows, bringing total weekly outflows to $795.8 million