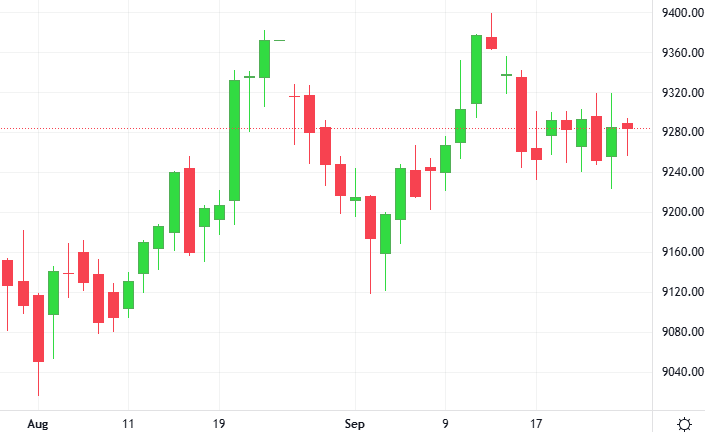

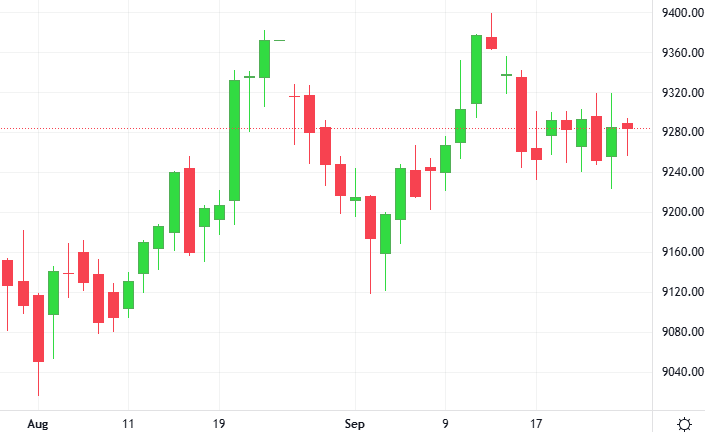

Britain’s FTSE 100 closed higher, led by miners and defence stocks, while investors assessed corporate updates and measured comments by Federal Reserve Chair Jerome Powell.

The benchmark FTSE 100 reversed earlier losses to gain 0.3%.

Britain’s FTSE 100 closed higher, led by miners and defence stocks, while investors assessed corporate updates and measured comments by Federal Reserve Chair Jerome Powell.

The benchmark FTSE 100 reversed earlier losses to gain 0.3%.

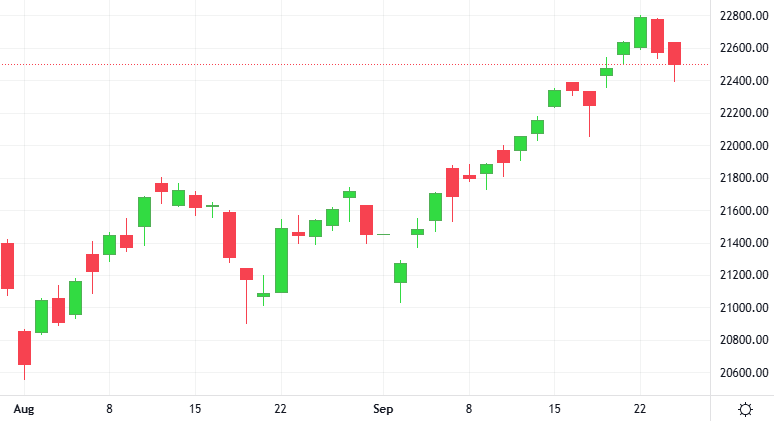

U.S. stocks retreated, as investors booked profits with indexes near record levels after Federal Reserve Chair Jerome Powell flagged potentially stretched stock prices and ahead of a reading on inflation later in the week.

The U.S. dollar held steady against major peers as investors weighed commentary from Federal Reserve officials on its monetary policy outlook, while the Swedish krona gained after the Riksbank delivered a hawkish 25-basis-point rate cut.

Oil prices settled up more than $1 a barrel after a deal to resume exports from Iraq’s Kurdistan stalled, pacifying some investor concerns that the restart would exacerbate worries about global oversupply.

All three of the major U.S. stock indexes were higher, with shares of Nvidia rising after it said it will invest up to $100 billion in OpenAI and some Federal Reserve officials expressed doubts on the need for further U.S. interest rate cuts.