The U.S. dollar slid on Friday and was set for its biggest weekly loss in over a year after President Donald Trump suggested a softer stance on tariffs against China, adding to uncertainty about the trade policy that kept equity markets on edge.

The U.S. dollar slid on Friday and was set for its biggest weekly loss in over a year after President Donald Trump suggested a softer stance on tariffs against China, adding to uncertainty about the trade policy that kept equity markets on edge.

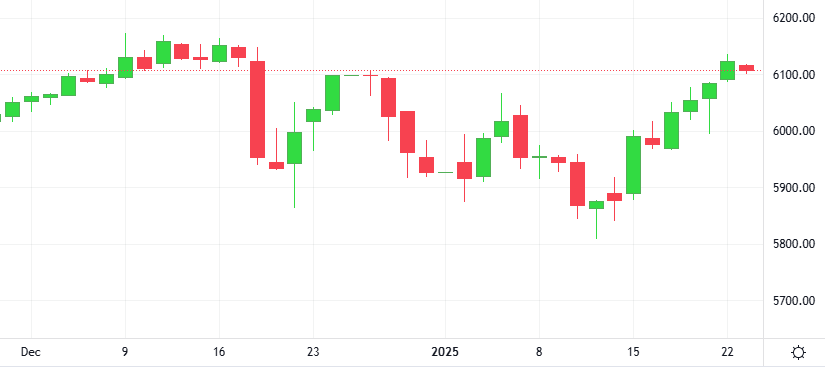

The benchmark S&P 500 rose to a record closing high, as investors assessed a mixed bag of corporate earnings and digested comments from President Donald Trump, including a call for cuts in interest rates and oil prices.

Oil fell 1% after U.S. President Donald Trump urged Saudi Arabia and OPEC to bring down its cost during his address at the World Economic Forum. Uncertainty over how Trump’s proposed tariffs and energy policies would affect global economic growth and energy demand also weighed on prices.

The Oil-Dollar pair corrected downwards in the last session, falling 0.2%. The ROC’s is giving a positive signal.

Support: 73.795 | Resistance: 77.185

The dollar was modestly lower in a choppy session, after comments from U.S. President Donald Trump called for lower interest rates while providing no clarity on tariffs, and investors awaited a round of policy announcements from global central banks.

Wall Street’s indexes rose, with the benchmark S&P 500 hitting an intraday record high as investors cheered streaming video provider Netflix’s quarterly report and President Donald Trump’s private-sector artificial intelligence infrastructure investment plan.

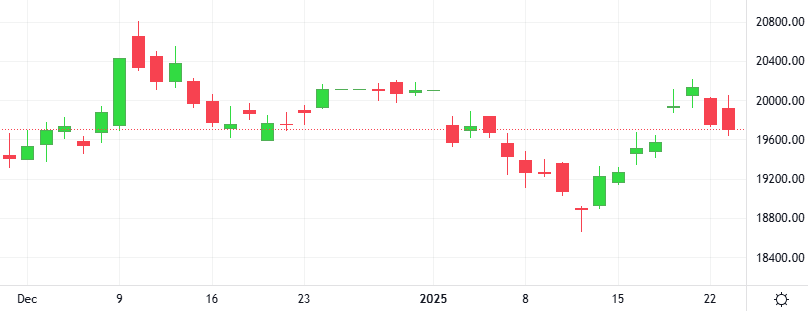

China said it will guide big state insurers and commercial insurance funds to increase investments in the A-share market, in a latest move to boost its lagging stock market. Big state-owned insurance companies will be directed to raise both the size and proportion of their investments in Chinese stocks listed on the mainland and equity funds.