The price of bitcoin topped $100,000 again early Friday as a pumped up cryptocurrency industry expects early action by Donald Trump when he’s sworn in as president next week.

The price of bitcoin topped $100,000 again early Friday as a pumped up cryptocurrency industry expects early action by Donald Trump when he’s sworn in as president next week.

BlackRock posted a 21% fourth quarter jump in profit after buoyant equity markets increased income from fees and drove its assets to a record high of $11.6 trillion, the world’s largest money manager said. The growth was partly driven by a U.S. stock market rally after Donald Trump’s presidential election victory in November.

The dollar weakened against major peers after cooler-than-expected data eased fears that inflation was accelerating and increased the chances the Federal Reserve could cut interest rates twice this year. The Bureau of Labor Statistics showed consumer prices rose 2.9% in the 12 months through December, in line with economists’ expectations.

The Dollar-Yen pair dropped 0.9% in the last session. The CCI indicates an oversold market.

Support: 153.48 | Resistance: 159.84

Fed policymakers may be able to reduce interest rates a couple of times this year, after a government report helped allay fears that inflation was accelerating in the final full month of Joe Biden’s presidency. The core consumer price index, which excludes food and energy prices and is seen as a gauge of underlying inflation pressures, rose 0.2% month-over-month in December.

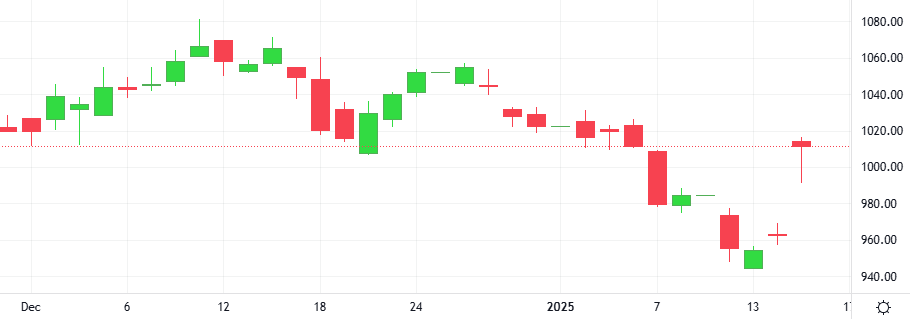

Deliveries of new Boeing jets bounced back in December after a crippling labor strike that slowed production last fall, but the company’s annual deliveries dropped in 2024 to the lowest level since the COVID-19 pandemic.

The dollar fell against the euro but was still hovering near its highest level in more than two years as the first of two inflation readings this week provided little assurance the U.S. Federal Reserve will soon cut interest rates.

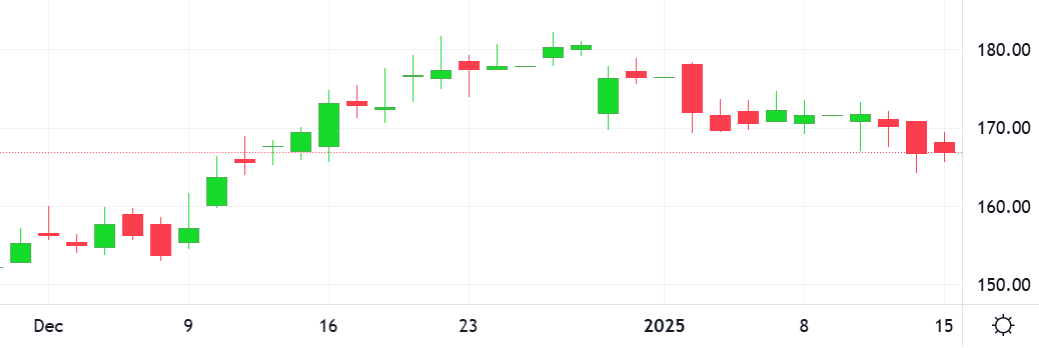

The Euro gained 0.5% against the Dollar in the last session. The Ultimate Oscillator’s is giving a negative signal.

Support: 1.0188 | Resistance: 1.0389